Family Dollar 2013 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

During fiscal 2014, we expect net sales to grow primarily due to the acceleration of our new store growth

and a modest increase in comparable stores sales.

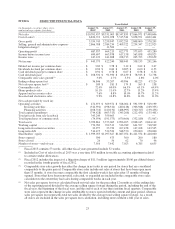

Results of Operations

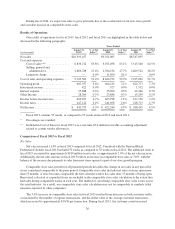

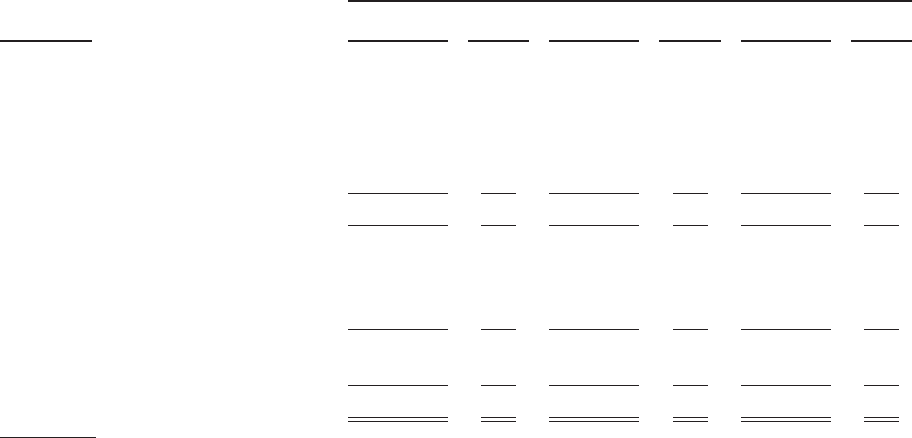

Our results of operations for fiscal 2013, fiscal 2012 and fiscal 2011 are highlighted in the table below and

discussed in the following paragraphs:

Years Ended

(in thousands)

August 31,

2013*

% of Net

Sales**

August 25,

2012

% of Net

Sales**

August 27,

2011

% of Net

Sales**

Net sales ......................... $10,391,457 $9,331,005 $8,547,835

Cost and expenses:

Cost of sales*** ............... 6,836,712 65.8% 6,071,058 65.1% 5,515,540 64.5%

Selling, general and

administrative ............... 2,866,788 27.6% 2,584,234 27.7% 2,409,522 28.2%

Litigation charge ............... — 0.0% 11,500 0.1% — 0.0%

Cost of sales and operating expenses . . . 9,703,500 93.4% 8,666,792 92.9% 7,925,062 92.7%

Operating profit ................... 687,957 6.6% 664,213 7.1% 622,773 7.3%

Investment income ................. 422 0.0% 927 0.0% 1,532 0.0%

Interest expense ................... 25,888 0.2% 25,090 0.3% 22,446 0.3%

Other Income ..................... 28,206 0.3% 23,888 0.3% 15,299 0.2%

Income before income taxes .......... 690,697 6.7% 663,938 7.1% 617,158 7.2%

Income taxes ...................... 247,122 2.4% 241,698 2.6% 228,713 2.7%

Net Income ....................... $ 443,575 4.3% $ 422,240 4.5% $ 388,445 4.5%

*Fiscal 2013 contains 53 weeks, as compared to 52 weeks in fiscal 2012 and fiscal 2011.

** Percentages are rounded.

*** Included in Cost of Sales for fiscal 2013 was a one-time $5.0 million favorable accounting adjustment

related to certain vendor allowances.

Comparison of Fiscal 2013 to Fiscal 2012

Net Sales

Net sales increased 11.4% in fiscal 2013 compared to fiscal 2012. Consistent with the National Retail

Federation Calendar, fiscal 2013 included 53 weeks as compared to 52 weeks in fiscal 2012. The additional week in

fiscal 2013 accounted for approximately $189 million in net sales, or approximately 2.0% of the net sales increase.

Additionally, the net sales increase in fiscal 2013 reflects an increase in comparable store sales of 3.0%, with the

balance of the increase due primarily to sales from new stores opened as part of our store growth program.

Comparable store sales growth for all presented periods describes the change in net sales in any period for

stores considered comparable to the prior period. Comparable store sales includes net sales at stores open more

than 13 months. A store becomes comparable the first calendar week it has sales after 13 months of being open.

Renovated, relocated or expanded stores are included in the comparable store sales calculation to the extent they

had sales during comparable weeks in each year. The method of calculating comparable store sales varies across

the retail industry. As a result, our comparable store sales calculation may not be comparable to similarly titled

measures reported by other companies.

The 3.0% increase in comparable store sales in fiscal 2013 resulted from increases in both customer traffic,

as measured by the number of register transactions, and the dollar value of the average customer transaction,

which increased to approximately $10.50 per transaction. During fiscal 2013, the customer count increased

26