Family Dollar 2013 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

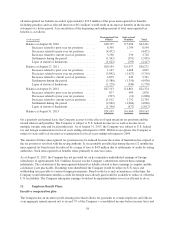

certain incentive compensation. Expenses under the profit-sharing plan were $9.4 million in fiscal 2013,

$12.3 million in fiscal 2012 and $17.8 million in fiscal 2011.

Compensation deferral plans

The Company has a voluntary compensation deferral plan, under Section 401(k) of the Internal Revenue Code,

available to eligible employees. At the discretion of the Board of Directors, the Company makes contributions to

the plan which are allocated to participants, and in which they become vested, in accordance with formulas and

schedules defined by the plan. Company expenses for contributions to the plan were $6.2 million in fiscal 2013,

$3.2 million in fiscal 2012 and $4.0 million in fiscal 2011, and are included in Selling General and

Administrative expenses on the Consolidated Statements of Income.

The Company has a deferred compensation plan to provide certain key management employees the ability to

defer a portion of their base compensation and bonuses. The plan is an unfunded nonqualified plan. The deferred

amounts and earnings thereon are payable to participants, or designated beneficiaries, at either specified future

dates, or upon separation from service or death. The Company does not make contributions to this plan or

guarantee earnings.

12. Commitments and Contingencies:

Operating leases and other contractual obligations

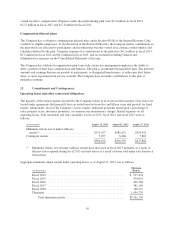

The majority of the rental expense incurred by the Company relates to its stores and the majority of its stores are

leased under agreements that generally have an initial term between five and fifteen years and provide for fixed

rentals. Additionally, most of the Company’s leases require additional payments based upon a percentage of

sales, property taxes, insurance premiums, or common area maintenance charges. Rental expenses on all

operating leases, both cancelable and non-cancelable, for fiscal 2013, fiscal 2012 and fiscal 2011 were as

follows:

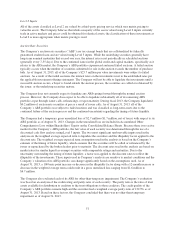

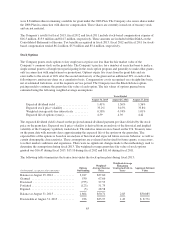

(in thousands) August 31, 2013 August 25, 2012 August 27, 2011

Minimum rentals, net of minor sublease

rentals(1) ................................ $555,107 $481,871 $429,942

Contingent rentals .......................... 9,057 8,468 7,862

$564,164 $490,339 $437,804

(1) Minimum rentals, net of minor sublease rentals have increased in fiscal 2013 primarily as a result of

the new stores opened during fiscal 2013 and new leases as a result of stores sold under sale-leaseback

transactions.

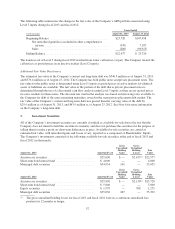

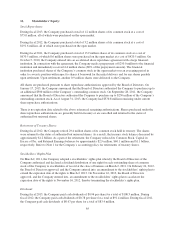

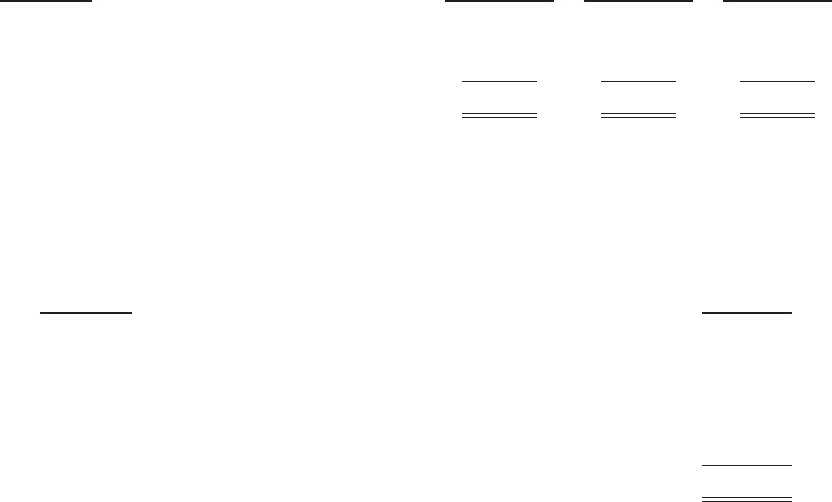

Aggregate minimum annual rentals under operating leases as of August 31, 2013, are as follows:

(in thousands)

Minimum

Rentals

Fiscal 2014 ..................................................... $ 515,254

Fiscal 2015 ..................................................... 474,601

Fiscal 2016 ..................................................... 426,788

Fiscal 2017 ..................................................... 381,196

Fiscal 2018 ..................................................... 328,527

Thereafter ...................................................... 1,434,770

Total minimum rentals ........................................ $3,561,136

59