Family Dollar 2013 Annual Report Download - page 17

Download and view the complete annual report

Please find page 17 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.leases and development agreements, competing against local competition, and gaining name recognition in new

markets. Unavailability of attractive store locations, delays in acquisition or opening of new stores and delays or

unexpected costs associated with remodeling and renovating existing stores may negatively impact new store

growth and profitability of remodeled or renovated stores. Additionally, difficulties in staffing and operating both

existing and new store locations and lack of customer acceptance of stores in new market areas or our renovated

store design may impact our ability to increase sales.

Our profitability is vulnerable to cost increases, inflation and energy prices.

Future increases in our costs, such as the cost of merchandise, shipping rates, freight and fuel costs, and

store occupancy costs, may reduce our profitability. These cost changes may be the result of inflationary

pressures that could further reduce our sales or profitability. Increases in other operating costs, including changes

in energy prices, wage rates and lease and utility costs, may increase our costs of sales or operating expenses and

reduce our profitability.

Our performance may be adversely impacted if we are not successful in managing our inventory balances.

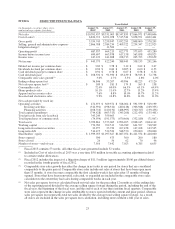

Our inventory balance represented approximately 40% of our total assets as of August 31, 2013. Efficient

inventory management is a key component of our business success and profitability. To be successful, we must

maintain sufficient inventory levels and an appropriate product mix to meet our customers’ demands, without

allowing those levels to increase to such an extent that the costs of storing and holding the goods adversely

impact our financial results. If our buying decisions do not accurately predict customer trends or our expectations

about customer spending levels are inaccurate, we may have to take unanticipated markdowns to dispose of the

excess inventory, which also can adversely impact our financial results. Additionally, we believe excess

inventory levels in stores subjects us to the risk of increased inventory shrinkage. If we are not successful in

managing our inventory balances and shrinkage, our results from operations and cash flows from operations may

be negatively affected.

We depend heavily on technology systems to support all aspects of our operations; the failure of existing or

new technology to provide anticipated benefits could adversely affect our results of operations.

Our business depends heavily upon the efficient operation of our technological resources. A failure in our

information technology systems or controls could negatively impact our operations. In addition, we continuously

upgrade our current technology or install new technology. Our inability to implement in a timely manner such

upgrades or installations, to train our employees effectively in the use of our technology, or to obtain the

anticipated benefits of our technology could adversely impact our operations or profitability.

Operational difficulties, including those associated with our ability to develop and operate our stores and

distribution facilities, could adversely impact our business.

Our stores are decentralized and are managed through a network of geographically dispersed management

personnel. In addition, we rely upon our distribution and logistics network to provide goods to stores in a timely

and cost-effective manner. Any disruption, unanticipated expense or operational failure related to this process

could impact our store operations negatively. We maintain a network of distribution facilities throughout our

geographic territory and build new facilities to support our growth objectives. Delays in opening distribution

facilities or stores could adversely affect our future operations by slowing the unit growth, which may in turn

reduce revenue growth. Adverse changes in the cost of operating distribution facilities and stores, such as

changes in labor, utility and other operating costs, could have an adverse impact on our financial performance.

Changes in and our compliance with state or federal legislation or regulations could impact our operations.

We employ more than 58,000 team members and are exposed to the risk of federal and state legislation,

particularly related to our team members, which may negatively impact our operations. Changes in federal or

13