Family Dollar 2013 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2013 Family Dollar annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

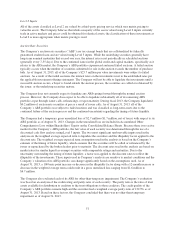

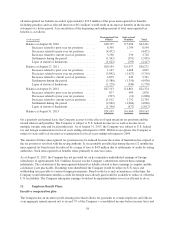

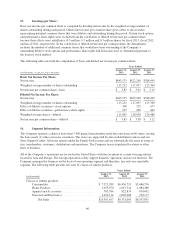

Additionally, the Company has outstanding standby letters of credit (which are primarily renewed on an annual

basis), of which the majority are used as surety for future premium and deductible payments to the Company’s

workers’ compensation and general liability insurance carrier. The following table shows the Company’s other

commercial commitments as of August 31, 2013:

(in thousands)

Total Amounts

Committed

Standby letters of credit .......................................... $48,767

Surety bonds ................................................... 37,036

Total ..................................................... $85,803

Litigation

The Company is engaged in a number of legal proceedings. The matters or groups of related matters discussed

below, if decided adversely to the Company, or settled by the Company, individually or in the aggregate, may

result in liability material to the Company’s financial condition or results of operations.

Wage and Hour Class Actions

Since 2004, certain individuals who held the position of store manager for the Company have filed lawsuits

alleging that the Company violated the Fair Labor Standards Act (“FLSA”), and/or similar state laws, by

classifying them as “exempt” employees who are not entitled to overtime compensation. Some of the cases also

seek to proceed as collective actions under the FLSA or as class actions under state laws. Plaintiffs seek recovery

of overtime pay, liquidated damages, attorneys’ fees, and court costs.

The Multi-District Litigation

Beginning in January 2001, the Company has been involved in a series of cases in which certain Store Managers

have alleged that they were improperly classified as exempt employees under the Fair Labor Standards Act

(“FLSA”). Current and former Store Managers have filed lawsuits alleging that the Company violated the FLSA

and/or similar state laws, by classifying them as “exempt” employees who are not entitled to overtime

compensation. The majority of the complaints in each action also request recovery of overtime pay, liquidated

damages, and attorneys’ fees, and court costs.

The first two of the MDL cases are Grace v. Family Dollar Stores, Inc. and Ward v. Family Dollar Stores, Inc.,

filed in May 2004 and June 2006, respectively, and were pending in the U.S. District Court for the Western

District of North Carolina, Charlotte Division (the “N.C. Federal Court”). In these cases, the court entered orders

finding that the plaintiffs were not similarly situated and, therefore, that neither nationwide notice nor collective

treatment under the FLSA is appropriate.

On July 9, 2009, the N.C. Federal Court granted summary judgment against Irene Grace on the merits of her

misclassification claim under the FLSA. To date, the N.C. Federal Court has granted 46 summary judgments

ruling that the Family Dollar Store Managers are properly classified as exempt employees.

The initial Grace and Ward plaintiffs appealed certain rulings of the N.C. Federal Court to the United States

Court of Appeals for the Fourth Circuit including the N.C. Federal Court’s summary judgment order against

Irene Grace. On March 22, 2011, the Fourth Circuit affirmed the N.C. Federal Court’s decision finding that

Ms. Grace was exempt from overtime compensation under the FLSA. The Fourth Circuit did not address the

class certification issue in the Grace and Ward cases as Ms. Grace’s lawsuit was dismissed on the merits. In

July 2013, the claims asserted by the remaining plaintiffs and opt-ins in the Grace and Ward cases were

dismissed in conjunction with a resolution of 39 appeals.

60