Dish Network 2007 Annual Report Download - page 98

Download and view the complete annual report

Please find page 98 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

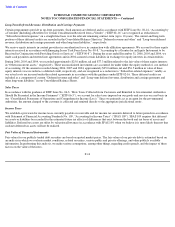

December 31, 2005 and 2004, we did not record any charge to earnings for other than temporary declines in the fair value of our non-

marketable investment securities.

We also have a strategic investment in non-public preferred stock, public common stock and convertible debt of a foreign public company

which is included in “Other noncurrent assets, net” on our Consolidated Balance Sheets. The debt is convertible into the issuer’s publicly

traded common shares. We account for the convertible debt at fair value with changes in fair value reported each period as unrealized gains or

losses in “Other” income or expense in our Consolidated Statements of Operations and Comprehensive Income (Loss). We estimate the fair

value of the convertible debt using certain assumptions and judgments in applying a discounted cash flow analysis and the Black-Scholes

option pricing model. As of December 31, 2006 and 2005, the fair value of the convertible debt was approximately $22.5 million and $42.3

million, respectively, based on the trading price of the issuer's shares on that date. During the second quarter of 2006, we converted a portion of

the convertible debt to public common shares and determined that we have the ability to significantly influence the operating decisions of the

issuer. Consequently, we account for the common share component of our investment under the equity method of accounting. Additionally,

during the years ended December 31, 2006 and 2005, we recognized a pre-tax unrealized loss of approximately $14.9 million and a gain of

$38.8 million for the change in the fair value of the convertible debt, respectively. As of December 31, 2006, we have $59.1 million recorded as

part of the total equity investment in “Other non-current assets, net” for the amount by which the carrying value of our investment in the

issuer’s common stock exceeds the value of our portion of the underlying balance sheet equity of the investee. As a result of our change from

cost to equity method accounting, we evaluate the common share component on a quarterly basis to determine whether declines in the fair

value of this security are other than temporary. This quarterly evaluation is similar to that used for marketable securities, as discussed above.

Our ability to realize value from our strategic investments in companies that are not publicly traded is dependent on the success of their

business and their ability to obtain sufficient capital to execute their business plans. Because private markets are not as liquid as public markets,

there is also increased risk that we will not be able to sell these investments, or that when we desire to sell them we will not be able to obtain

fair value for them.

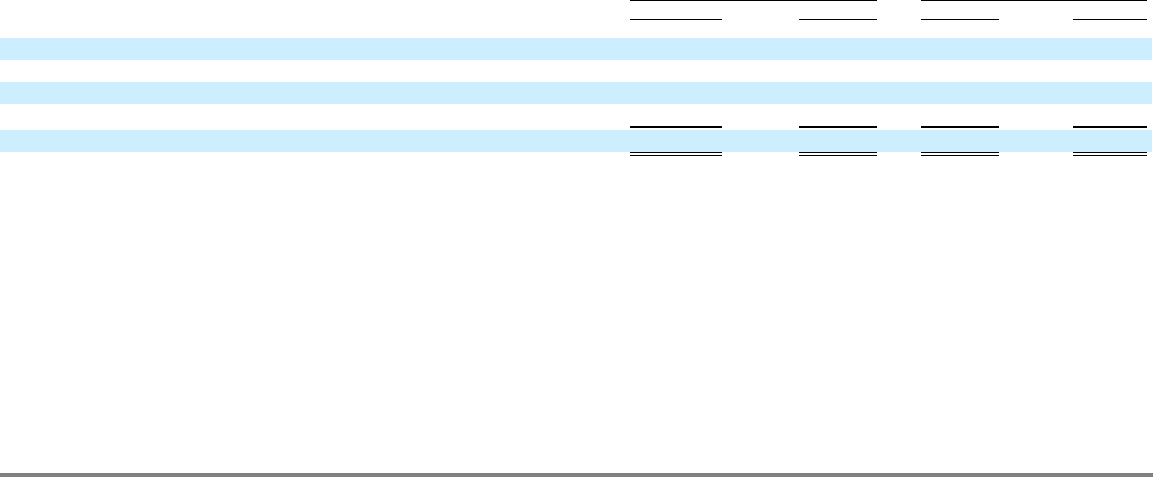

Restricted Cash and Marketable Investment Securities.

As of December 31, 2006 and 2005, restricted cash and marketable investment

securities included amounts set aside as collateral for investments in marketable securities and our letters of credit. Additionally, restricted cash

and marketable investment securities as of December 31, 2006 included $101.3 million in escrow related to our litigation with Tivo.

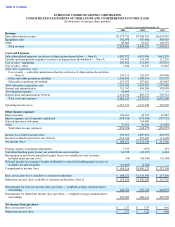

The major components of marketable investment securities and restricted cash are as follows:

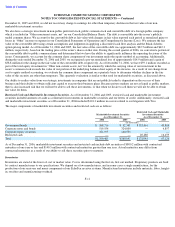

As of December 31, 2006, marketable investment securities and restricted cash include debt securities of $800.2 million with contractual

maturities of one year or less and $140.5 million with contractual maturities greater than one year. Actual maturities may differ from

contractual maturities as a result of our ability to sell these securities prior to maturity.

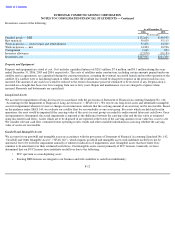

Inventories

Inventories are stated at the lower of cost or market value. Cost is determined using the first-in, first-out method. Proprietary products are built

by contract manufacturers to our specifications. We depend on a few manufacturers, and in some cases a single manufacturer, for the

production of our receivers and many components of our EchoStar receiver systems. Manufactured inventories include materials, labor, freight-

in, royalties and manufacturing overhead.

F-11

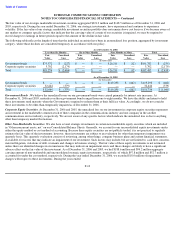

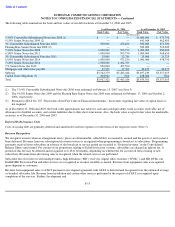

Restricted Cash and Marketable

Marketable Investment Securities

Investment Securities

As of December 31,

As of December 31,

2006

2005

2006

2005

(In thousands)

Government bonds

$

268,716

$

92,341

$

152,461

45,804

Corporate notes and bonds

519,554

324,800

—

4,857

Corporate equity securities

321,195

148,550

—

—

Restricted cash

—

—

20,480

16,459

Total

$

1,109,465

$

565,691

$

172,941

67,120