Dish Network 2007 Annual Report Download - page 108

Download and view the complete annual report

Please find page 108 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

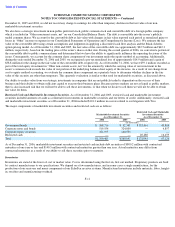

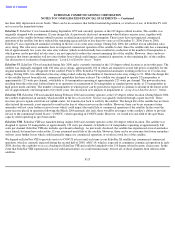

market value of our Class A common stock at the date of grant and a maximum term of ten years. While historically our Board of Directors has

issued options that vest at the rate of 20% per year, some option grants have immediately vested.

Effective January 26, 2005, we adopted a long-term, performance-based stock incentive plan (the “2005 LTIP”) within the terms of our 1999

Stock Incentive Plan to provide incentive to our executive officers and certain other key employees upon achievement of specified long-term

business objectives. In general, employees participating in the 2005 LTIP elect to receive a one-time award of: (i) an option to acquire a

specified number of shares priced at market value on the date of the awards; (ii) rights to acquire for no additional consideration a specified

smaller number of shares of our Class A common stock; or (iii) a corresponding combination of a lesser number of option shares and such

rights to acquire our Class A common stock. The options and rights are subject to certain performance criteria and vest over a seven year period

at the rate of 10% per year during the first four years, and at the rate of 20% per year thereafter.

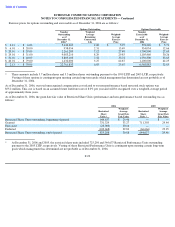

Options to purchase 5.7 million shares pursuant to a long-term incentive plan under our 1995 Stock Incentive Plan (the “1999 LTIP”), and

5.3 million shares pursuant to the 2005 LTIP were outstanding as of December 31, 2006. These options were granted with exercise prices at

least equal to the market value of the underlying shares on the dates they were issued. The weighted-average exercise price of these options is

$8.80 under our 1999 LTIP and $29.78 under our 2005 LTIP. The weighted-average fair value of the options granted during 2006 pursuant to

the 2005 LTIP was $15.43. Further, pursuant to the 2005 LTIP, there were also 725,298 outstanding Restricted Performance Units as of

December 31, 2006 with a weighted-average grant date fair value of $30.80. Vesting of these options and Restricted Performance Units is

contingent upon meeting certain long-term goals which management has determined are not probable as of December 31, 2006. Consequently,

no compensation was recorded during the year ended December 31, 2006 related to these long-term options and Restricted Performance Units.

In accordance with SFAS 123R, such compensation, if recorded, would result in total non-cash, stock-based compensation expense of

$138.0 million, of which $115.7 million relates to performance based options and $22.3 million relates to Restricted Performance Units. This

would be recognized ratably over the remaining vesting period or expensed immediately, if fully vested, in our Consolidated Statements of

Operations and Comprehensive Income (Loss).

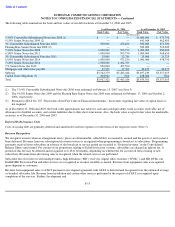

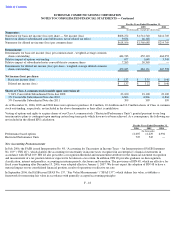

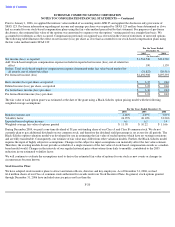

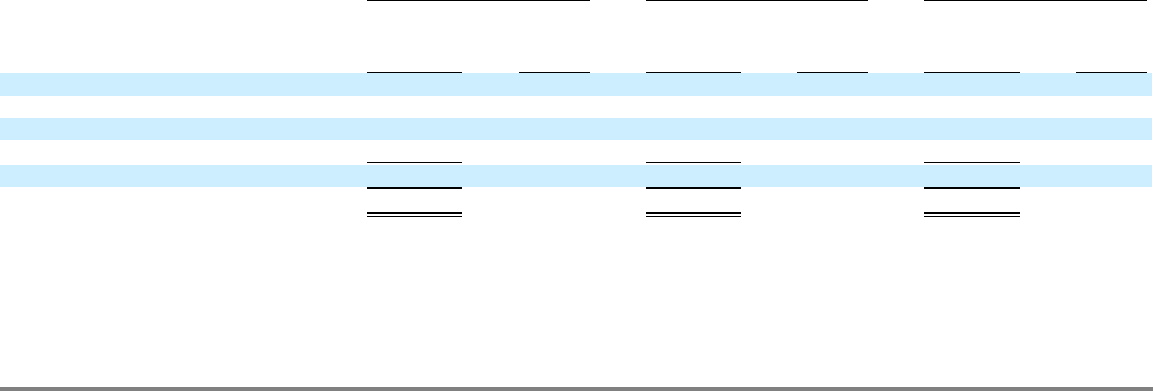

A summary of our stock option activity for the years ended December 31, 2006, 2005 and 2004 is as follows:

The tax benefit realized from share options exercised during the year ended December 31, 2006 was $10.9 million. Based on the average

market value for the year ended December 31, 2006, the aggregate intrinsic value for the options outstanding was $186.9 million, of which

$32.3 million was exercisable at the end of the period.

F-21

2006

2005

2004

Weighted

-

Weighted

-

Weighted

-

Average

Average

Average

Exercise

Exercise

Exercise

Options

Price

Options

Price

Options

Price

Options outstanding, beginning of year

25,086,883

$

24.43

17,734,216

$

21.06

17,818,818

$

16.62

Granted

2,155,500

32.41

10,361,250

29.17

4,238,000

31.64

Exercised

(1,519,550

)

14.14

(916,328

)

8.32

(2,182,498

)

6.63

Forfeited and Cancelled

(2,961,000

)

25.99

(2,092,255

)

26.38

(2,140,104

)

19.80

Options outstanding, end of year

22,761,833

25.67

25,086,883

24.43

17,734,216

21.06

Exercisable at end of year

6,568,883

32.85

6,914,133

29.54

5,662,416

25.95