Dish Network 2007 Annual Report Download - page 92

Download and view the complete annual report

Please find page 92 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

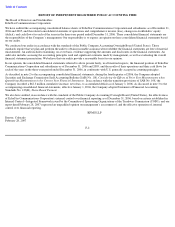

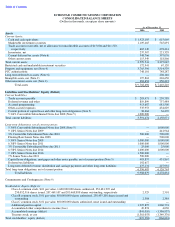

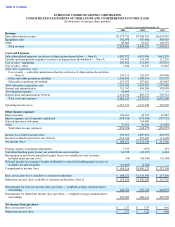

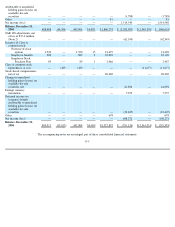

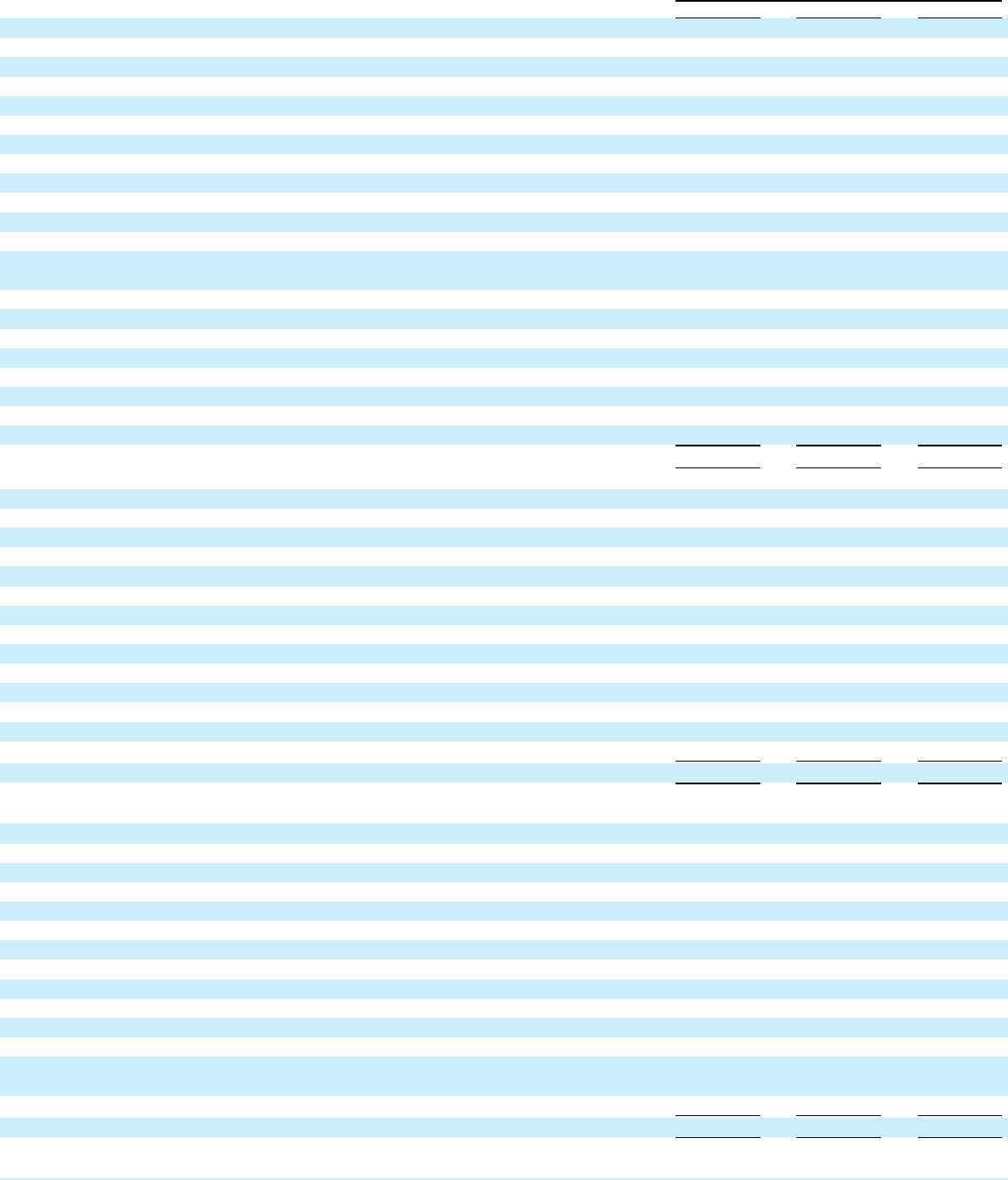

ECHOSTAR COMMUNICATIONS CORPORATION

CONSOLIDATED STATEMENTS OF CASH FLOWS

(In thousands)

For the Years Ended December 31,

2006

2005

2004

Cash Flows From Operating Activities:

Net income (loss)

$

608,272

$

1,514,540

$

214,769

Adjustments to reconcile net income (loss) to net cash flows from operating activities:

Depreciation and amortization

1,114,294

805,573

505,561

Equity in losses (earnings) of affiliates

4,749

(1,579

)

(5,686

)

Realized and unrealized losses (gains) on investments

(53,543

)

(42,813

)

9,031

Gain on insurance settlement

—

(

134,000

)

—

Non

-

cash, stock

-

based compensation recognized

17,645

302

1,180

Deferred tax expense (benefit) (Note 6)

252,340

(539,885

)

5,362

Amortization of debt discount and deferred financing costs

10,023

6,301

22,262

Other, net

(4,330

)

4,086

9,942

Change in noncurrent assets

54,462

21,756

(114,705

)

Change in long-term deferred revenue, distribution and carriage payments and other

long

-

term liabilities

26,018

(49,112

)

109,522

Changes in current assets and current liabilities:

Trade accounts receivable

(190,218

)

(5,653

)

(122,986

)

Allowance for doubtful accounts

3,483

1,981

(2,643

)

Inventories

16,743

71,988

(73,161

)

Other current assets

5,700

(20,052

)

(44,757

)

Trade accounts payable

47,182

(7,426

)

76,152

Deferred revenue and other

54,082

(2,961

)

211,161

Accrued programming and other accrued expenses

312,340

151,028

200,438

Net cash flows from operating activities

2,279,242

1,774,074

1,001,442

Cash Flows From Investing Activities:

Purchases of marketable investment securities

(2,046,882

)

(676,478

)

(1,932,789

)

Sales and maturities of marketable investment securities

1,474,662

552,521

4,096,005

Purchases of property and equipment

(1,396,318

)

(1,506,394

)

(980,587

)

Proceeds from insurance settlement

—

240,000

—

Change in cash reserved for satellite insurance

—

—

158,335

Change in restricted cash and marketable investment securities

(1,243

)

(16,728

)

7,590

Asset acquisition

—

—

(

238,610

)

FCC auction deposits

—

1,555

(26,684

)

Purchase of FCC licenses

—

(

8,961

)

—

Purchase of technology

-

based intangibles

—

(

25,500

)

—

Purchase of strategic investments included in noncurrent assets and other

(27,572

)

(19,822

)

—

Proceeds from sale of strategic investment included in noncurrent assets

9,682

—

—

Other

(6,282

)

(535

)

(4,979

)

Net cash flows from investing activities

(1,993,953

)

(1,460,342

)

1,078,281

Cash Flows From Financing Activities:

Proceeds from issuance of 7 1/8% Senior Notes due 2016

1,500,000

—

—

Proceeds from issuance of 7% Senior Notes due 2013

500,000

—

—

Proceeds from issuance of 6 5/8% Senior Notes due 2014

—

—

1,000,000

Proceeds from issuance of 3% Convertible Subordinated Notes due 2011

—

—

25,000

Redemption of Floating Rate Senior Notes due 2008

(500,000

)

—

—

Redemption and repurchases of 9 1/8% Senior Notes due 2009, respectively

(441,964

)

(4,189

)

(8,847

)

Redemption of 10 3/8% Senior Notes due 2007

—

—

(

1,000,000

)

Redemption of 9 3/8% Senior Notes due 2009

—

—

(

1,423,351

)

Class A common stock repurchases (Note 7)

(11,677

)

(362,512

)

(809,609

)

Deferred debt issuance costs

(14,210

)

—

(

3,159

)

Cash dividend on Class A and Class B common stock

—

—

(

455,650

)

Repayment of capital lease obligations, mortgages and other notes payable

(41,015

)

(45,961

)

(6,998

)

Net proceeds from Class A common stock options exercised and Class A common stock

issued under Employee Stock Purchase Plan

23,957

10,039

16,592

Tax benefit recognized on stock option exercises

7,056

—

—

Net cash flows from financing activities

1,022,147

(402,623

)

(2,666,022

)

Net increase (decrease) in cash and cash equivalents

1,307,436

(88,891

)

(586,299

)