Dish Network 2007 Annual Report Download - page 73

Download and view the complete annual report

Please find page 73 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

among other things, fund operations, make strategic investments and expand the business. Consequently, the size of this portfolio fluctuates

significantly as cash is received and used in our business.

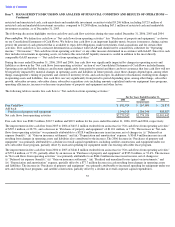

Our restricted and unrestricted cash, cash equivalents and marketable investment securities had an average annual return for the year ended

December 31, 2006 of 5.4%. A hypothetical 10.0% decrease in interest rates would result in a decrease of approximately $12.6 million in

annual interest income. The value of certain of the investments in this portfolio can be impacted by, among other things, the risk of adverse

changes in securities and economic markets generally, as well as the risks related to the performance of the companies whose commercial paper

and other instruments we hold. However, the high quality of these investments (as assessed by independent rating agencies), reduces these

risks. The value of these investments can also be impacted by interest rate fluctuations.

At December 31, 2006, all of the $2.884 billion was invested in fixed or variable rate instruments or money market type accounts. While an

increase in interest rates would ordinarily adversely impact the fair value of fixed and variable rate investments, we normally hold these

investments to maturity. Consequently, neither interest rate fluctuations nor other market risks typically result in significant realized gains or

losses to this portfolio. A decrease in interest rates has the effect of reducing our future annual interest income from this portfolio, since funds

would be re-invested at lower rates as the instruments mature.

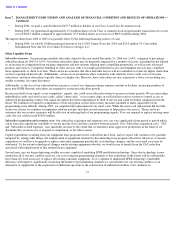

Included in our marketable investment securities portfolio balance is debt and equity of public companies we hold for strategic and financial

purposes. As of December 31, 2006, we held strategic and financial debt and equity investments of public companies with a fair value of

$321.2 million. We may make additional strategic and financial investments in debt and other equity securities in the future. The fair value of

our strategic and financial debt and equity investments can be significantly impacted by the risk of adverse changes in securities markets

generally, as well as risks related to the performance of the companies whose securities we have invested in, risks associated with specific

industries, and other factors. These investments are subject to significant fluctuations in fair value due to the volatility of the securities markets

and of the underlying businesses. A hypothetical 10.0% adverse change in the price of our public strategic debt and equity investments would

result in approximately a $32.1 million decrease in the fair value of that portfolio. The fair value of our strategic debt investments are currently

not materially impacted by interest rate fluctuations due to the nature of these investments.

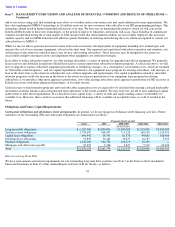

We currently classify all marketable investment securities as available-for-sale. We adjust the carrying value of our available-for-

sale securities

to fair value and report the related temporary unrealized gains and losses as a separate component of “Accumulated other comprehensive

income (loss)” within “Total stockholders’ equity (deficit),” net of related deferred income tax. Declines in the fair value of a marketable

investment security which are estimated to be “other than temporary” are recognized in the Consolidated Statements of Operations and

Comprehensive Income (Loss), thus establishing a new cost basis for such investment. We evaluate our marketable investment securities

portfolio on a quarterly basis to determine whether declines in the fair value of these securities are other than temporary. This quarterly

evaluation consists of reviewing, among other things, the fair value of our marketable investment securities compared to the carrying amount,

the historical volatility of the price of each security and any market and company specific factors related to each security. Generally, absent

specific factors to the contrary, declines in the fair value of investments below cost basis for a continuous period of less than six months are

considered to be temporary. Declines in the fair value of investments for a continuous period of six to nine months are evaluated on a case by

case basis to determine whether any company or market-

specific factors exist which would indicate that such declines are other than temporary.

Declines in the fair value of investments below cost basis for a continuous period greater than nine months are considered other than temporary

and are recorded as charges to earnings, absent specific factors to the contrary.

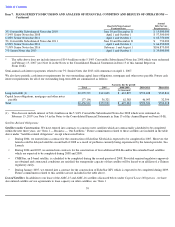

As of December 31, 2006, we had unrealized gains net of related tax effect of $41.8 million as a part of “Accumulated other comprehensive

income (loss)” within “Total stockholders’ equity (deficit).” During the year ended December 31, 2006, we did not record any charge to

earnings for other than temporary declines in the fair value of our marketable investment securities. In addition, during 2006, we recognized

realized and unrealized net gains on marketable investment securities and conversion of bond instruments into common stock of $88.6 million.

During the year ended December 31, 2006, our strategic investments have experienced and continue to experience volatility. If the fair value of

our strategic marketable investment securities portfolio does not remain above cost basis or if we become aware of any market or company

specific factors that indicate that the carrying value of certain of our securities is impaired, we may be required to record charges to earnings in

future periods equal to the amount of the decline in fair value.

65