Dish Network 2007 Annual Report Download - page 113

Download and view the complete annual report

Please find page 113 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

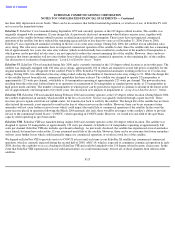

EchoStar IX.

EchoStar IX was launched during August 2003 and currently operates at the 121 degree orbital location. The satellite was

designed to operate 32 FSS transponders operating at approximately 110 watts per channel, along with transponders that can provide services

in the Ka-Band (a “Ka-band payload”). EchoStar IX provides expanded video and audio channels to DISH Network subscribers who install a

specially-designed dish. The Ka-band spectrum is being used to test and verify potential future broadband initiatives and to implement those

services. The satellite also includes a C-band payload which is owned by a third party. During the fourth quarter of 2006, EchoStar IX

experienced the loss of one of its three momentum wheels, two of which are utilized during normal operations. A spare wheel was switched in

at the time and the loss did not reduce the 12-year estimated useful life of the satellite. However, there can be no assurance future anomalies

will not cause further losses, which could impact the remaining life or commercial operation of the satellite.

EchoStar X

. EchoStar X was launched during February 2006 and currently operates at the 110 degree orbital location. Its 49 spot beams use

up to 42 active 140 watt TWTAs to provide standard and HD local channels, and other programming, to markets across the United States. In

the event our EchoStar X satellite experienced a significant failure, we would lose the ability to deliver local network channels in many

markets. While we would attempt to minimize the number of lost markets through the use of spare satellites and programming line up changes,

some markets would be without local channels until a replacement satellite with similar spot beam capability could be launched and

operational.

EchoStar XII.

EchoStar XII was launched during July 2003 and currently operates at the 61.5 degree orbital location. The satellite was

designed to operate 13 transponders at 270 watts per channel, in CONUS mode, or 22 spot beams using a combination of 135 and 65 watt

TWTAs. We currently operate the satellite in CONUS mode. EchoStar XII has a total of 24 solar array circuits, approximately 22 of which are

required to assure full power for the original minimum 12-year design life of the satellite. Prior to 2006, two solar array circuits failed, one of

which was subsequently restored to partial use. During 2006, three additional solar array circuits failed. The cause of the failures is being

investigated. While the design life of the satellite has not been affected, in future years the power loss will cause a reduction in the number of

transponders which can be operated. The exact extent of this impact has not yet been determined. There can be no assurance future anomalies

will not cause further losses, which could further impact commercial operation of the satellite or its useful life. See discussion of evaluation of

impairment in “ Long-Lived Satellite Assets ” below.

Long

-Lived Satellite Assets. We account for impairments of long-lived satellite assets in accordance with the provisions of Statement of

Financial Accounting Standards No. 144, “ Accounting for the Impairment or Disposal of Long-Lived Assets ” (“SFAS 144”). SFAS 144

requires a long-lived asset or asset group to be tested for recoverability whenever events or changes in circumstance indicate that its carrying

amount may not be recoverable. Based on the guidance under SFAS 144, we evaluate our satellite fleet for recoverability as one asset group.

While certain of the anomalies discussed above, and previously disclosed, may be considered to represent a significant adverse change in the

physical condition of an individual satellite, based on the redundancy designed within each satellite and considering the asset grouping, these

anomalies (none of which caused a loss of service to subscribers for an extended period) are not considered to be significant events that would

require evaluation for impairment recognition pursuant to the guidance under SFAS 144. Unless and until a specific satellite is abandoned or

otherwise determined to have no service potential, the net carrying amount related to the satellite would not be written off.

5. Long-Term Debt

5 3/4% Convertible Subordinated Notes due 2008

Effective February 15, 2007, we redeemed all of our outstanding 5 3/4% Convertible Subordinated Notes due 2008. In accordance with the

terms of the indenture governing the notes, the $1.0 billion principal amount of the notes was redeemed at a redemption price of 101.643% of

the principal amount, for a total of $1.016 billion. The premium

F-26