Dish Network 2007 Annual Report Download - page 121

Download and view the complete annual report

Please find page 121 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

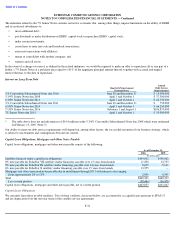

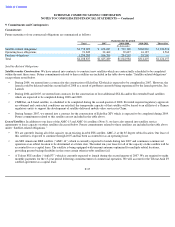

The year ended December 31, 2006 includes a credit of $13.5 million related to the recognition of state net operating loss carryforwards

(“NOLs”) for prior periods. In addition, the year ended December 31, 2006, includes a credit of $8.3 million related to amended state filings.

The income tax benefit for the year ended December 31, 2005 included credits of $592.8 million and $322.0 million to our provision for

income taxes resulting from the reversal and current year activity, respectively, of our recorded valuation allowance.

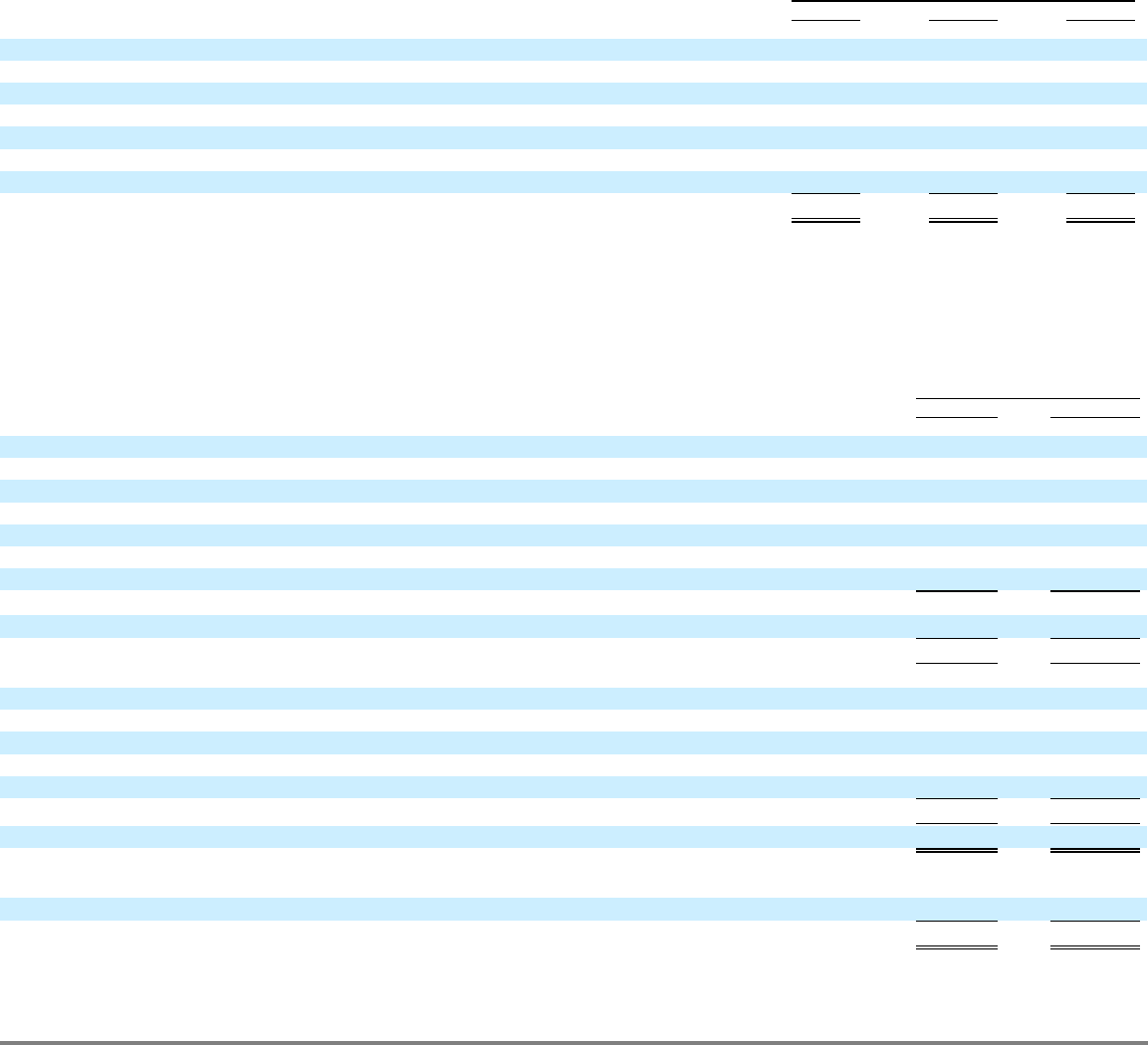

The temporary differences, which give rise to deferred tax assets and liabilities as of December 31, 2006 and 2005, are as follows:

F-34

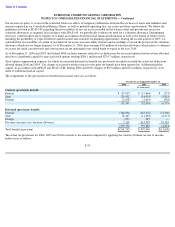

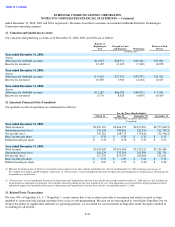

For the Years Ended December 31,

2006

2005

2004

% of pre

-

tax (income)/loss

Statutory rate

(35.0

)

(35.0

)

(35.0

)

State income taxes, net of Federal benefit

0.7

(1.7

)

(3.5

)

Foreign taxes and income not U.S. taxable

(0.3

)

(0.1

)

(0.8

)

Stock option compensation

0.2

(0.5

)

(0.6

)

Deferred tax asset adjustment for filed returns

(0.6

)

(2.8

)

2.3

Other

0.1

(0.3

)

(1.5

)

Decrease (increase) in valuation allowance

0.8

90.8

34.0

Total benefit (provision) for income taxes

(34.1

)

50.4

(5.1

)

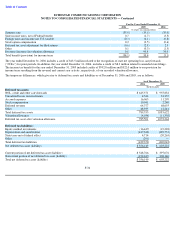

As of December 31,

2006

2005

(In thousands)

Deferred tax assets:

NOL, credit and other carryforwards

$

645,571

$

955,832

Unrealized losses on investments

4,546

33,355

Accrued expenses

16,065

11,299

Stock compensation

10,041

2,240

Deferred revenue

64,377

68,655

Other

48,935

12,241

Total deferred tax assets

789,535

1,083,622

Valuation allowance

(4,034

)

(11,358

)

Deferred tax asset after valuation allowance

785,501

1,072,264

Deferred tax liabilities:

Equity method investments

(16,447

)

(19,228

)

Depreciation and amortization

(417,328

)

(429,551

)

State taxes net of federal effect

4,714

(20,263

)

Other

(291

)

—

Total deferred tax liabilities

(429,352

)

(469,042

)

Net deferred tax asset (liability)

$

356,149

$

603,222

Current portion of net deferred tax asset (liability)

$

548,766

$

397,076

Noncurrent portion of net deferred tax asset (liability)

(192,617

)

206,146

Total net deferred tax asset (liability)

$

356,149

$

603,222