Dish Network 2007 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

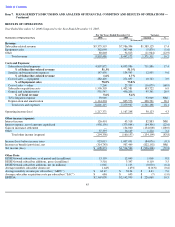

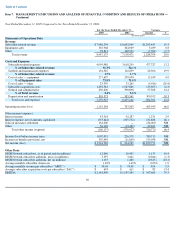

DISH Network subscribers

. As of December 31, 2005, we had approximately 12.040 million DISH Network subscribers compared to

approximately 10.905 million subscribers at December 31, 2004, an increase of approximately 10.4%. DISH Network added approximately

3.397 million gross new subscribers for the year ended December 31, 2005, compared to approximately 3.441 million gross new subscribers

during 2004, a decrease of approximately 44,000 gross new subscribers. The decrease in gross new subscribers resulted primarily from a

decline in gross activations under our co-branding agreement with AT&T, partially offset by an increase in sales through our agency

relationships and an increase in our other distribution channels.

DISH Network added approximately 1.135 million net new subscribers for the year ended December 31, 2005, compared to approximately

1.480 million net new subscribers during 2004, a decrease of approximately 23.3%. This decrease was primarily a result of increased

subscriber churn on a larger subscriber base, and the result of a decline in gross and net activations under our co-branding agreement with

AT&T. In addition, even if percentage subscriber churn had remained constant or had declined, increasing numbers of gross new subscribers

are required to sustain net subscriber growth.

Subscriber

-related revenue . DISH Network “Subscriber-related revenue” totaled $7.986 billion for the year ended December 31, 2005, an

increase of $1.293 billion or 19.3% compared to 2004. This increase was directly attributable to continued DISH Network subscriber growth

and the increase in “ARPU” discussed below.

ARPU

. Monthly average revenue per subscriber was $58.04 during the year ended December 31, 2005 versus $55.00 during the same period

in 2004. The $3.04 or 5.5% increase in monthly average revenue per DISH Network subscriber is primarily attributable to price increases in

February 2005 and 2004 on some of our most popular packages, higher equipment rental fees resulting from increased penetration of our

equipment leasing programs, availability of local channels by satellite and fees for DVRs. This increase was also attributable to our relationship

with AT&T, including revenues from equipment sales, installation and other services related to that agreement. These improvements in ARPU

were partially offset by an increase in our free and discounted programming promotions. We provided local channels by satellite in 164

markets as of December 31, 2005 compared to 152 markets as of December 31, 2004. We regularly have promotions to acquire new DISH

Network subscribers which provide free and/or discounted programming that negatively impact ARPU.

Equipment sales

. For the year ended December 31, 2005, “Equipment sales” totaled $368.0 million, an increase of $3.0 million or 0.8%

compared to the same period during 2004. This increase principally resulted from an increase in sales of non-DISH Network digital receivers

and related components to an international DBS service provider, partially offset by decreases in sales of DBS accessories domestically.

Subscriber

-related expenses. “Subscriber-related expenses” totaled $4.096 billion during the year ended December 31, 2005, an increase of

$477.7 million or 13.2% compared to 2004. The increase in “Subscriber-related expenses” was primarily attributable to the increase in the

number of DISH Network subscribers, which resulted in increased expenses to support the DISH Network. “Subscriber-related expenses”

represented 51.3% and 54.1% of “Subscriber-related revenue”

during the years ended December 31, 2005 and 2004, respectively. The decrease

in this expense to revenue ratio primarily resulted from the increase in “Subscriber-related revenue” and an increase in the number of DISH

Network subscribers participating in our lease program for existing subscribers. Since certain subscriber retention costs associated with this

program are capitalized rather than expensed, our “Subscriber-related expenses” decreased and our capital expenditures increased. The

decrease in the ratio also resulted from improved efficiencies associated with our installation and in-home service operations. The decrease in

this expense to revenue ratio was partially offset by increases in cost associated with deferred equipment sales, installation and other services

related to our relationship under our prior agreement with AT&T. The decrease in the ratio was also partially offset by $15.7 million more in

charges during 2005 compared to 2004 for the replacement of smart cards.

Satellite and transmission expenses

. “Satellite and transmission expenses” totaled $134.5 million during the year ended December 31, 2005,

an increase of $22.3 million or 19.9% compared to 2004. This increase primarily resulted from commencement of service and operational costs

associated with the increasing number of markets in which we offer local broadcast channels by satellite as previously discussed, increases in

our satellite lease payment obligations for AMC-2, and operational costs associated with our capital leases of AMC-15 and AMC-16 which

commenced commercial operation in January and February 2005, respectively. “Satellite and transmission expenses” totaled 1.7% of

“Subscriber-related revenue” during each of the years ended December 31, 2005 and

51

Item 7.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS —

Continued