Dish Network 2007 Annual Report Download - page 91

Download and view the complete annual report

Please find page 91 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

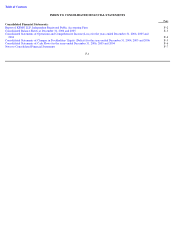

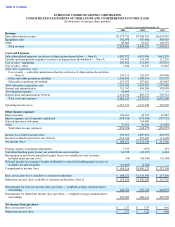

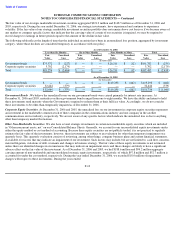

The accompanying notes are an integral part of these consolidated financial statements.

F-5

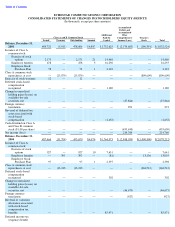

attributable to unrealized

holding gains (losses) on

available

-

for

-

sale

securities

—

—

—

—

—

(

1,788

)

—

(

1,788

)

Other

—

—

—

—

81

—

—

81

Net income (loss)

—

—

—

—

—

1,514,540

—

1,514,540

Balance, December 31,

2005

488,488

(44,584

)

443,904

$

4,885

$

1,860,774

$

(1,382,907

)

$

(1,349,376

)

$

(866,624

)

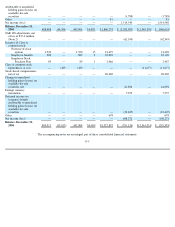

SAB 108 adjustments, net

of tax of $37.4 million

(Note 2)

—

—

—

—

—

(

62,345

)

—

(

62,345

)

Issuance of Class A

common stock:

Exercise of stock

options

1,520

—

1,520

15

21,475

—

—

21,490

Employee benefits

820

—

820

8

22,094

—

—

22,102

Employee Stock

Purchase Plan

89

—

89

1

2,466

—

—

2,467

Class A common stock

repurchases, at cost

—

(

429

)

(429

)

—

—

—

(

11,677

)

(11,677

)

Stock-based compensation,

net of tax

—

—

—

—

20,430

—

—

20,430

Change in unrealized

holding gains (losses) on

available-for-sale

securities, net

—

—

—

—

—

61,894

—

61,894

Foreign currency

translation

—

—

—

—

—

7,355

—

7,355

Deferred income tax

(expense) benefit

attributable to unrealized

holding gains (losses) on

available-for-sale

securities

—

—

—

—

—

(

23,405

)

—

(

23,405

)

Other

—

—

—

—

658

—

—

658

Net income (loss)

—

—

—

—

—

608,272

—

608,272

Balance, December 31,

2006

490,917

(45,013

)

445,904

$

4,909

$

1,927,897

$

(791,136

)

$

(1,361,053

)

$

(219,383

)