Dish Network 2007 Annual Report Download - page 119

Download and view the complete annual report

Please find page 119 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

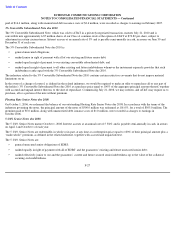

AMC

-15. We make monthly payments to SES Americom to lease all of the capacity on AMC 15, an FSS satellite, which commenced

commercial operation during January 2005. The ten-year satellite service agreement is renewable by us on a year to year basis following the

initial term, and provides us with certain rights to replacement satellites.

AMC

-16. We also make monthly payments to SES Americom to lease all of the capacity on AMC 16, an FSS satellite, which commenced

commercial operation during February 2005. The ten-year satellite service agreement is renewable by us on a year to year basis following the

initial term, and provides us with certain rights to replacement satellites.

As of December 31, 2006 and 2005, we had $551.6 million capitalized for the estimated fair value of satellites acquired under capital leases

included in “Property and equipment, net,” with related accumulated depreciation of $108.5 million and $53.3 million, respectively. In our

Consolidated Statements of Operations and Comprehensive Income (Loss), we recognized $55.2 million and $53.3 million in depreciation

expense on satellites acquired under capital lease agreements during the years ended December 31, 2006 and 2005, respectively. During 2004,

we did not recognize any depreciation on the satellites acquired under these capital leases.

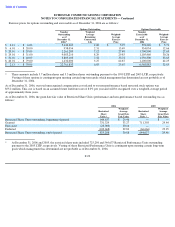

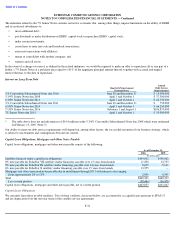

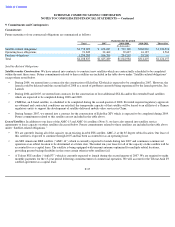

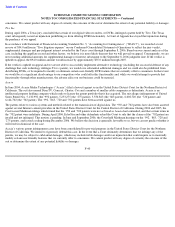

Future minimum lease payments under these capital lease obligations, together with the present value of the net minimum lease payments as of

December 31, 2006 are as follows:

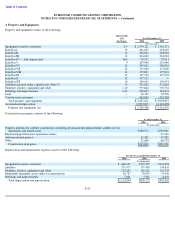

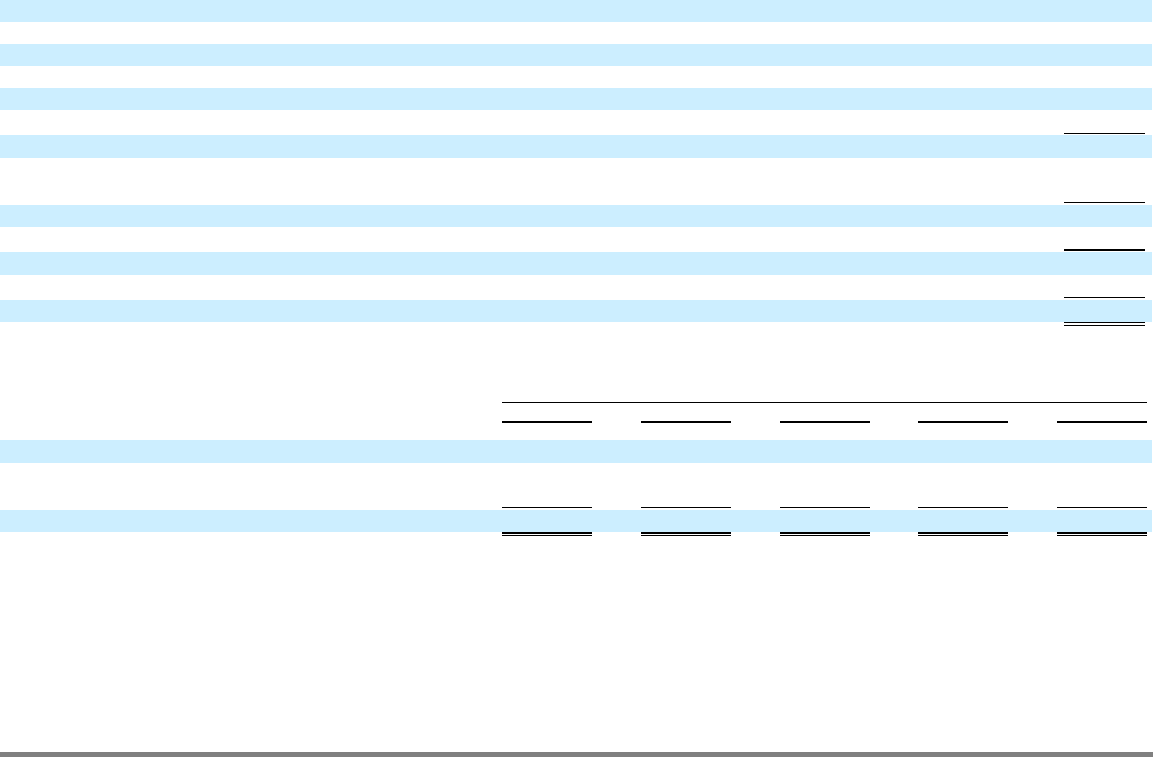

Future maturities of our outstanding long-term debt, including the current portion, are summarized as follows:

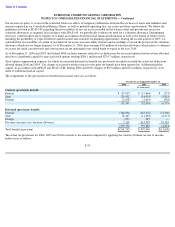

6. Income Taxes

As of December 31, 2006, we had net operating loss carryforwards (“NOL’s”) for federal income tax purposes of $1.641 billion and tax

benefits related to credit carryforwards of $41.9 million. We have recorded in 2006, tax benefits for state NOL carryforwards of $26.3 million.

The NOL’s begin to expire in the year 2020 and credit carryforwards will begin to expire in the year 2010.

F-32

For the Year Ending December 31, 2007

$

86,351

2008

86,351

2009

86,351

2010

86,351

2011

86,351

Thereafter

254,374

Total minimum lease payments

686,129

Less: Amount representing lease of the orbital location and estimated executory costs (primarily insurance and maintenance)

including profit thereon, included in total minimum lease payments

(120,660

)

Net minimum lease payments

565,469

Less: Amount representing interest

(160,527

)

Present value of net minimum lease payments

404,942

Less: Current portion

(34,701

)

Long

-

term portion of capital lease obligations

$

370,241

Payments due by period

Total

2007

2008-2009

2010-2011

Thereafter

(In thousands)

Long

-

term debt obligations

$

6,525,000

$

1,000,000

$

1,000,000

$

1,525,000

$

3,000,000

Capital lease obligations, mortgages and other notes

payable

442,321

38,469

87,053

105,593

211,206

Total

$

6,967,321

$

1,038,469

$

1,087,053

$

1,605,593

$

3,236,206