Dish Network 2007 Annual Report Download - page 101

Download and view the complete annual report

Please find page 101 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

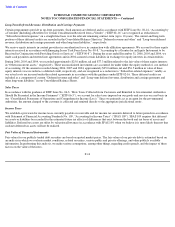

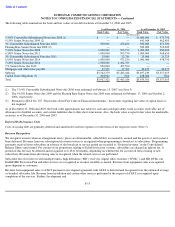

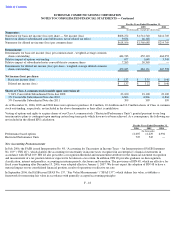

Long

-Term Deferred Revenue, Distribution and Carriage Payments

Certain programmers provide us up-front payments. Such amounts are deferred and in accordance with EITF Issue No. 02-16, “Accounting by

a Customer (Including a Reseller) for Certain Consideration Received from a Vendor” (“EITF 02-16”) are recognized as reductions to

“Subscriber-related expenses” on a straight-line basis over the relevant remaining contract term (up to 10 years). The current and long-term

portions of these deferred credits are recorded in the Consolidated Balance Sheets in “Deferred revenue and other” and “Long-term deferred

revenue, distribution and carriage payments and other long-term liabilities,” respectively.

We receive equity interests in content providers in consideration for or in conjunction with affiliation agreements. We account for these equity

interests received in accordance with Emerging Issues Task Force Issue No. 00-8, “Accounting by a Grantee for an Equity Instrument to be

Received in Conjunction with Providing Goods or Services” (“EITF 00-8”). During the years ended December 31, 2006, 2005 and 2004, we

made cash payments and entered into agreements and in 2004 assumed certain liabilities in exchange for equity interests in certain entities.

During 2006, 2005 and 2004, we recorded approximately $25.0 million, nil and $77.3 million related to the fair value of these equity interests

in “Other noncurrent assets,” respectively. These unconsolidated investments are accounted for under either the equity method or cost method

of accounting. Of the amounts recorded during 2006, 2005 and 2004, approximately $25.0 million, nil and $56.5 million in value of these

equity interests was recorded as a deferred credit, respectively, and are recognized as a reduction to “Subscriber-related expenses” ratably as

our actual costs are incurred under the related agreements in accordance with the guidance under EITF 02-16. These deferred credits are

included as a component of current “Deferred revenue and other” and “Long-term deferred revenue, distribution and carriage payments and

other long-term liabilities” in our Consolidated Balance Sheets.

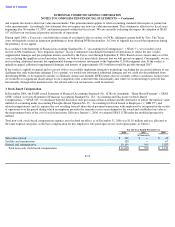

Sales Taxes

In accordance with the guidance of EITF Issue No. 06-3, “How Taxes Collected from Customers and Remitted to Governmental Authorities

Should Be Presented in the Income Statement” (“EITF 06-3”), we account for sales taxes imposed on our goods and services on a net basis in

our “Consolidated Statements of Operations and Comprehensive Income (Loss).” Since we primarily act as an agent for the governmental

authorities, the amount charged to the customer is collected and remitted directly to the appropriate jurisdictional entity.

Income Taxes

We establish a provision for income taxes currently payable or receivable and for income tax amounts deferred to future periods in accordance

with Statement of Financial Accounting Standards No. 109, “Accounting for Income Taxes” (“SFAS 109”). SFAS 109 requires that deferred

tax assets or liabilities be recorded for the estimated future tax effects of differences that exist between the book and tax bases of assets and

liabilities. Deferred tax assets are offset by valuation allowances in accordance with SFAS 109, when we believe it is more likely than not that

such net deferred tax assets will not be realized.

Fair Value of Financial Instruments

Fair values for our publicly traded debt securities are based on quoted market prices. The fair values of our private debt is estimated based on

an analysis in which we evaluate market conditions, related securities, various public and private offerings, and other publicly available

information. In performing this analysis, we make various assumptions, among other things, regarding credit spreads, and the impact of these

factors on the value of the notes.

F-14