Dish Network 2007 Annual Report Download - page 131

Download and view the complete annual report

Please find page 131 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

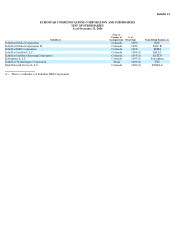

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

ended December 31, 2006, 2005 and 2004, respectively. Revenues from these customers are included within the EchoStar Technologies

Corporation operating segment.

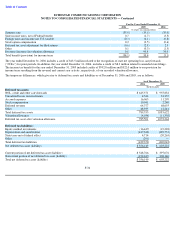

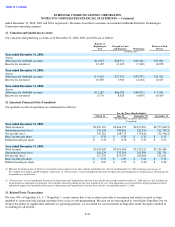

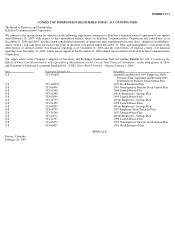

11. Valuation and Qualifying Accounts

Our valuation and qualifying accounts as of December 31, 2006, 2005 and 2004 are as follows:

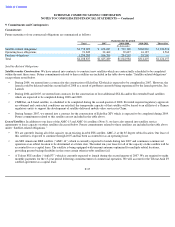

12. Quarterly Financial Data (Unaudited)

Our quarterly results of operations are summarized as follows:

13. Related Party Transactions

We own 50% of NagraStar L.L.C. (“NagraStar”), a joint venture that is our exclusive provider of encryption and related security systems

intended to assure that only paying customers have access to our programming. Because we are not required to consolidate NagraStar, but we

do have the ability to significantly influence its operating policies, we accounted for our investment in NagraStar under the equity method of

accounting for all periods

F

-

44

Balance at

Beginning of

Charged to Costs

Balance at End

Year

and Expenses

Deductions

of Year

(In thousands)

Year ended December 31, 2006:

Assets:

Allowance for doubtful accounts

$

11,523

$

68,911

$

(65,428

)

$

15,006

Reserve for inventory

10,185

10,123

(7,430

)

12,878

Year ended December 31, 2005:

Assets:

Allowance for doubtful accounts

$

9,542

$

57,351

$

(55,370

)

$

11,523

Reserve for inventory

10,389

3,980

(4,184

)

10,185

Year ended December 31, 2004:

Assets:

Allowance for doubtful accounts

$

12,185

$

66,289

$

(68,932

)

$

9,542

Reserve for inventory

6,770

8,428

(4,809

)

10,389

For the Three Months Ended

March 31

June 30

September 30

December 31

(In thousands, except per share data)

(Unaudited)

Year ended December 31, 2006:

Total revenue(1)

$

2,299,391

$

2,466,155

$

2,475,291

$

2,577,649

(2)

Operating income (loss)

274,196

349,641

281,810

311,724

(2)

Net income (loss)

147,281

168,779

139,616

152,596

(2)

Basic income per share

$

0.33

$

0.38

$

0.31

$

0.35

Diluted income per share

$

0.33

$

0.38

$

0.31

$

0.35

Year ended December 31, 2005:

Total revenue

$

2,024,000

$

2,095,486

$

2,128,221

$

2,199,468

Operating income (loss)

290,234

333,394

291,884

251,736

Net income (loss)

317,524

855,527

208,864

132,625

Basic income per share

$

0.70

$

1.89

$

0.46

$

0.30

Diluted income per share

$

0.69

$

1.79

$

0.46

$

0.28

(1)

Effective the fourth quarter of 2006 we reclassified certain amounts for the three months ended March 31, June 30 and September 30, 2006 resulting in an increase of

$9.7 million, $7.5 million and $3.9 million, respectively, in “Total revenue” in our Consolidated Statements of Operations and Comprehensive Income (Loss). Net Income for

the periods was not affected.

(2)

“Total revenue” in our Consolidated Statements of Operations and Comprehensive Income (Loss) for the three months ended December 31, 2006 reflects a $13.8 million out

of period pre-tax adjustment for payments received from subscribers during the first nine months of the year. This adjustment was not material to all prior periods presented

and did not impact our Consolidated Statements of Operations and Comprehensive Income (Loss) for the year ended December 31, 2006.