Dish Network 2007 Annual Report Download - page 115

Download and view the complete annual report

Please find page 115 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

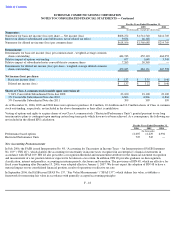

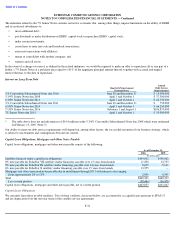

The indenture related to the 5 3/4% Senior Notes contains restrictive covenants that, among other things, impose limitations on the ability of

EDBS and its restricted subsidiaries to:

In the event of a change of control, as defined in the related indenture, we would be required to make an offer to repurchase all or any part of a

holder’s 5 3/4% Senior Notes at a purchase price equal to 101% of the aggregate principal amount thereof, together with accrued and unpaid

interest thereon, to the date of repurchase.

6 3/8% Senior Notes due 2011

The 6 3/8% Senior Notes mature October 1, 2011. Interest accrues at an annual rate of 6 3/8% and is payable semi-annually in cash, in arrears

on April 1 and October 1 of each year.

The 6 3/8% Senior Notes are redeemable, in whole or in part, at any time at a redemption price equal to 100% of their principal amount plus a

“make-whole” premium, as defined in the related indenture, together with accrued and unpaid interest.

The 6 3/8% Senior Notes are:

The indenture related to the 6 3/8% Senior Notes contains restrictive covenants that, among other things, impose limitations on the ability of

EDBS and its restricted subsidiaries to:

In the event of a change of control, as defined in the related indenture, we would be required to make an offer to repurchase all or any part of a

holder’s 6 3/8% Senior Notes at a purchase price equal to 101% of the aggregate principal amount thereof, together with accrued and unpaid

interest thereon, to the date of repurchase.

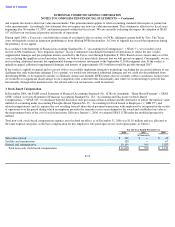

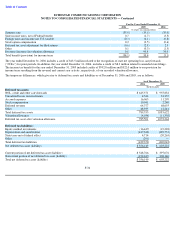

3% Convertible Subordinated Note due 2011

The 3% Convertible Subordinated Note, which was sold to CenturyTel Service Group, LLC (“CTL”) in a privately negotiated transaction,

matures August 25, 2011 and is convertible into 398,724 shares of our Class A common stock at the option of CTL at $62.70 per share, subject

to adjustment in certain circumstances. Interest accrues at an annual rate of 3% and is payable semi-annually in cash, in arrears on June 30 and

December 31 of each year.

F-28

•

incur additional indebtedness or enter into sale and leaseback transactions;

•

pay dividends or make distribution on EDBS

’

capital stock or repurchase EDBS

’

capital stock;

•

make certain investments;

•

create liens;

•

enter into transactions with affiliates;

•

merge or consolidate with another company; and

•

transfer and sell assets.

•

general unsecured senior obligations of EDBS;

•

ranked equally in right of payment with all of EDBS

’

and the guarantors

’

existing and future unsecured senior debt;

• ranked effectively junior to our and the guarantors’ current and future secured senior indebtedness up to the value of the collateral

securing such indebtedness.

•

incur additional indebtedness or enter into sale and leaseback transactions;

•

pay dividends or make distribution on EDBS

’

capital stock or repurchase EDBS

’

capital stock;

•

make certain investments;

•

create liens;

•

enter into transactions with affiliates;

•

merge or consolidate with another company; and

•

transfer and sell assets.