Dish Network 2007 Annual Report Download - page 106

Download and view the complete annual report

Please find page 106 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

and expands disclosures about fair value measurements. This pronouncement applies to other accounting standards that require or permit fair

value measurements. Accordingly, this statement does not require any new fair value measurement. This statement is effective for fiscal years

beginning after November 15, 2007, and interim periods within that fiscal year. We are currently evaluating the impact the adoption of SFAS

157 will have on our financial position and results of operations.

During April 2006, a Texas jury concluded that certain of our digital video recorders, or DVRs, infringed a patent held by Tivo. The Texas

court subsequently issued an injunction prohibiting us from offering DVR functionality. A Court of Appeals has stayed that injunction during

the pendency of our appeal.

In accordance with Statement of Financial Accounting Standard No. 5, “Accounting for Contingencies” (“SFAS 5”), we recorded a total

reserve of $94.0 million in “Tivo litigation expense” on our Condensed Consolidated Statement of Operations to reflect the jury verdict,

supplemental damages and pre-judgment interest awarded by the Texas court through September 8, 2006. Based on our current analysis of the

case, including the appellate record and other factors, we believe it is more likely than not that we will prevail on appeal. Consequently, we are

not recording additional amounts for supplemental damages or interest subsequent to the September 8, 2006 judgment date. If the verdict is

upheld on appeal, additional supplemental damages and interest of approximately $35.0 million would be payable through 2007.

If the verdict is upheld on appeal and we are not able to successfully implement alternative technology (including the successful defense of any

challenge that such technology infringes Tivo’s patent), we would owe substantial additional damages and we could also be prohibited from

distributing DVRs, or be required to modify or eliminate certain user-friendly DVR features that we currently offer to consumers. In that event

we would be at a significant disadvantage to our competitors who could offer this functionality and, while we would attempt to provide that

functionality through other manufacturers, the adverse affect on our business could be material.

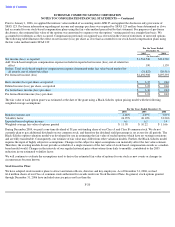

3. Stock-Based Compensation

In December 2004, the FASB issued Statement of Financial Accounting Standards No. 123R (As Amended), “Share-Based Payment” (“SFAS

123R”) which (i) revises Statement of Financial Accounting Standard No. 123, “Accounting and Disclosure of Stock-Based

Compensation,” (“SFAS 123”)

to eliminate both the disclosure only provisions of that statement and the alternative to follow the intrinsic value

method of accounting under Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees” (“APB 25”) and

related interpretations, and (ii) requires the cost resulting from all share-

based payment transactions with employees be recognized in the results

of operations over the period during which an employee provides the requisite service in exchange for the award and establishes fair value as

the measurement basis of the cost of such transactions. Effective January 1, 2006, we adopted SFAS 123R under the modified prospective

method.

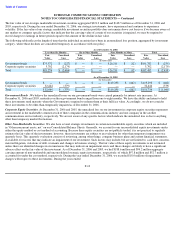

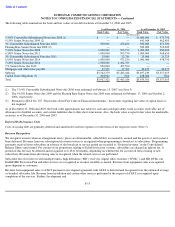

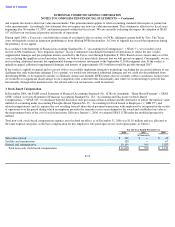

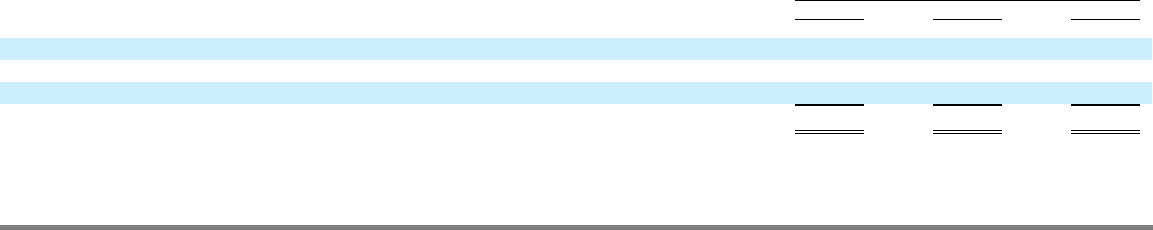

Total non-cash, stock-based compensation expense, net of related tax effect, as of December 31, 2006 was $11.0 million and was allocated to

the same expense categories as the base compensation for key employees who participate in our stock option plans, as follows:

F-19

For the Year Ended December 31,

2006

2005

2004

(In thousands)

Subscriber

-

related

$

549

$

—

$

49

Satellite and transmission

320

—

67

General and administrative

10,149

190

1,023

Total non

-

cash, stock based compensation

$

11,018

$

190

$

1,139