Dish Network 2007 Annual Report Download - page 47

Download and view the complete annual report

Please find page 47 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

EXECUTIVE SUMMARY

Overview

During 2006, we continued to position the DISH Network as the low price leader in the U.S. pay TV industry, while at the same time offering

the highest quality programming, customer service and customer choice possible. We subsidize the cost of equipment and installation, and

offer other promotions, to increase our subscriber base. We also focused on increasing distribution of our highly rated DVR and HD

equipment, as value ads to drive subscriber growth and retention.

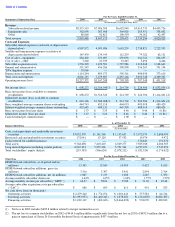

As a result, our subscriber base continued to grow. That growth, together with increased average monthly revenue per subscriber, resulted in

continued revenue growth. Net income and free cash flow also continued to increase.

We believe opportunity exists to continue growing our subscriber base. One of our biggest challenges, and opportunities, is to further improve

operating results through better cost control and operating efficiency.

Operational Results and Goals

Adding new subscribers.

During 2006, we added approximately 3.516 million new subscribers, an increase of 3.4% from 2005. We intend to

continue adding new subscribers by offering compelling value-

based consumer promotions. These promotions include offers of free or low cost

advanced consumer electronics products, such as receivers with multiple tuners, HD receivers, DVRs, and HD DVRs, as well as programming

packages which we believe generally have a better “price-to-value” relationship than packages currently offered by most other subscription

television providers.

However, there are many reasons we may not be able to maintain our current rate of new subscriber growth. For example, many of our

competitors are better equipped than we are to offer video services bundled with broadband and other telecommunications services. Our

subscriber growth would also be negatively impacted to the extent our competitors offer more attractive consumer promotions.

Minimize existing customer churn.

In order to continue to increase our subscriber base we must minimize our rate of customer turnover, or

“churn.” Our average monthly subscriber churn rate for the year ended December 31, 2006 was approximately 1.64%. We attempt to contain

churn by offering high quality customer service, low prices, and advanced products and services not available from competitors. We also

require service commitments from subscribers and tailor our promotions toward subscribers desiring multiple receivers and advanced products

such as receivers with multiple tuners, DVRs and HD receivers, who tend to remain our customers for longer periods. In addition, we maintain

disciplined credit requirements, such as requiring most new subscribers to provide a valid major credit card and to have an acceptable credit

score. We also plan to continue to offer advanced products to existing customers through our lease promotions and to initiate other programs to

improve our overall subscriber retention. However, there can be no assurance that these and other actions we may take to control churn will be

successful.

39

Item 7.

MANAGEMENT’S DISCUSSION AND ANALYSIS OF FINANCIAL CONDITION AND RESULTS OF OPERATIONS