Dish Network 2007 Annual Report Download - page 96

Download and view the complete annual report

Please find page 96 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

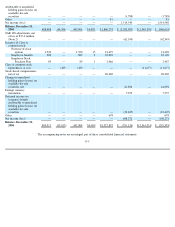

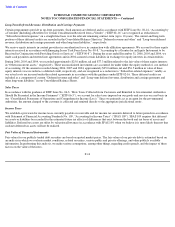

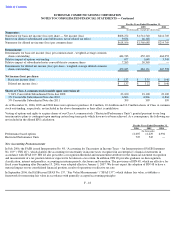

Statements of Cash Flows Data

The following presents our supplemental cash flow statement disclosure:

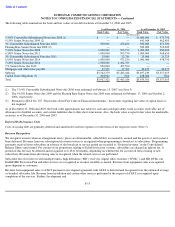

Cash and Cash Equivalents

We consider all liquid investments purchased with an original maturity of 90 days or less to be cash equivalents. Cash equivalents as of

December 31, 2006 and 2005 consist of money market funds, government bonds, corporate notes and commercial paper. The cost of these

investments approximates their fair value.

Marketable and Non

-Marketable Investment Securities and Restricted Cash

We currently classify all marketable investment securities as available-for-sale. We adjust the carrying value of our available-for-

sale securities

to fair value and report the related temporary unrealized gains and losses as a separate component of “Accumulated other comprehensive

income (loss)” within “Total stockholders’ equity (deficit),” net of related deferred income tax. Declines in the fair value of a marketable

investment security which are estimated to be “other than temporary” are recognized in the Consolidated Statements of Operations and

Comprehensive Income (Loss), thus establishing a new cost basis for such investment. We evaluate our marketable investment securities

portfolio on a quarterly basis to determine whether declines in the fair value of these securities are other than temporary. This quarterly

evaluation consists of reviewing, among other things, the fair value of our marketable investment securities compared to the carrying amount,

the historical volatility of the price of each security and any market and company specific factors related to each security. Generally, absent

specific factors to the contrary, declines in the fair value of investments below cost basis for a continuous period of less than six months are

considered to be temporary. Declines in the fair value of investments for a continuous period of six to nine months are evaluated on a case by

case basis to determine whether any company or market-

specific factors exist which would indicate that such declines are other than temporary.

Declines in the fair value of investments below cost basis for a continuous period greater than nine months are considered other than temporary

and are recorded as charges to earnings, absent specific factors to the contrary.

As of December 31, 2006 and 2005, we had unrealized gains net of related tax effect of $41.8 million and $3.3 million, respectively, as a part

of “Accumulated other comprehensive income (loss)” within “Total stockholders’ equity (deficit).” During the year ended December 31, 2005,

we recorded aggregate charges to earnings for other than temporary declines in the fair value of certain of our marketable investment securities

of $25.4 million, and established a new cost basis for these securities. During the years ended December 31, 2006 and 2004, we did not record

any charge to earnings for other than temporary declines in the fair value of our marketable investment securities. In addition, during the years

ended December 31, 2006, 2005 and 2004, we recognized realized and unrealized net gains (losses) on marketable investment securities and

conversion of bond instruments into common stock of $88.6 million, $34.3 million and ($9.0) million, respectively.

F-9

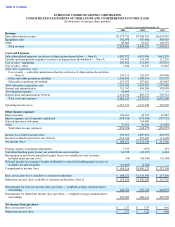

For the Years Ended December 31,

2006

2005

2004

(In thousands)

Cash paid for interest

$

418,587

$

372,403

$

431,785

Capitalized interest

20,091

7,597

3,105

Cash received for interest

73,337

34,623

56,317

Cash paid for income taxes

37,742

34,295

3,302

Assumption of net operating liabilities in asset acquisition

—

—

25,685

Assumption of liabilities and long

-

term deferred revenue

—

—

69,357

Employee benefits paid in Class A common stock

22,102

13,055

16,255

Satellites financed under capital lease obligations

—

191,950

286,605

Reduction in satellite vendor financing

—

—

13,712

Satellite and other vendor financing

15,000

1,940

6,519