Dish Network 2007 Annual Report Download - page 116

Download and view the complete annual report

Please find page 116 of the 2007 Dish Network annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Table of Contents

ECHOSTAR COMMUNICATIONS CORPORATION

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS — Continued

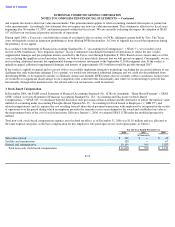

The 3% Convertible Subordinated Note due 2011 is:

The indenture related to the 3% Convertible Subordinated Note due 2011 contains certain restrictive covenants that do not impose material

limitations on us.

In the event of a change of control, as defined in the related indenture, we would be required to make an offer to repurchase all or any part of

the holder’

s 3% Convertible Subordinated Note due 2011 at a purchase price equal to 100% of the aggregate principal amount thereof, together

with accrued and unpaid interest thereon, to the date of repurchase. Commencing August 25, 2009, we may redeem, and CTL may require us to

purchase, all or a portion of the note without premium.

6 5/8% Senior Notes due 2014

The 6 5/8% Senior Notes mature October 1, 2014. Interest accrues at an annual rate of 6 5/8% and is payable semi-annually in cash, in arrears

on April 1 and October 1 of each year.

The 6 5/8% Senior Notes are redeemable, in whole or in part, at any time at a redemption price equal to 100% of their principal amount plus a

“make-whole” premium, as defined in the related indenture, together with accrued and unpaid interest. Prior to October 1, 2007, we may also

redeem up to 35% of each of the 6 5/8% Senior Notes at specified premiums with the net cash proceeds from certain equity offerings or capital

contributions.

The 6 5/8% Senior Notes are:

The indenture related to the 6 5/8% Senior Notes contains restrictive covenants that, among other things, impose limitations on the ability of

EDBS and its restricted subsidiaries to:

In the event of a change of control, as defined in the related indenture, we would be required to make an offer to repurchase all or any part of a

holder’s 6 5/8% Senior Notes at a purchase price equal to 101% of the aggregate principal amount thereof, together with accrued and unpaid

interest thereon, to the date of repurchase.

7 1/8% Senior Notes due 2016

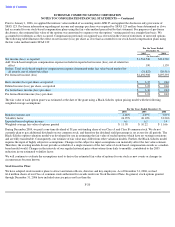

On February 2, 2006, we sold $1.5 billion aggregate principal amount of our ten-year, 7 1/8% Senior Notes due February 1, 2016. Interest

accrues at an annual rate of 7 1/8% and is payable semi-annually in cash, in arrears on

F-29

•

general unsecured obligations;

•

ranked junior in right of payment with all of our existing and future senior debt;

•

ranked equal in right of payment to our existing convertible subordinated debt; and

• ranked equal in right of payment to all other existing and future indebtedness whenever the instrument expressly provides that such

indebtedness ranks equal with the 3% Convertible Subordinated Note due 2011.

•

general unsecured senior obligations of EDBS;

•

ranked equally in right of payment with all of EDBS

’

and the guarantors

’

existing and future unsecured senior debt;

• ranked effectively junior to our and the guarantors’ current and future secured senior indebtedness up to the value of the collateral

securing such indebtedness.

•

incur additional indebtedness or enter into sale and leaseback transactions;

•

pay dividends or make distribution on EDBS

’

capital stock or repurchase EDBS

’

capital stock;

•

make certain investments;

•

create liens;

•

enter into transactions with affiliates;

•

merge or consolidate with another company; and

•

transfer and sell assets.