Columbia Sportswear 2009 Annual Report Download - page 72

Download and view the complete annual report

Please find page 72 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

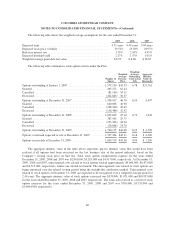

2009 2008 2007

Assets:

United States ........................................... $ 916,847 $ 857,228 $ 872,027

EMEA ................................................ 249,838 246,072 239,007

LAAP ................................................ 104,734 93,773 78,308

Canada ................................................ 127,205 89,463 97,815

Total identifiable assets ................................... 1,398,624 1,286,536 1,287,157

Eliminations and reclassifications ........................... (185,741) (138,300) (120,676)

Total assets ........................................ $1,212,883 $1,148,236 $1,166,481

Net sales to unrelated entities:

Sportswear ............................................. $ 472,508 $ 540,903 $ 565,591

Outerwear ............................................. 482,512 491,777 497,551

Footwear .............................................. 214,565 217,237 227,434

Accessories and equipment ................................ 74,438 67,918 65,463

$1,244,023 $1,317,835 $1,356,039

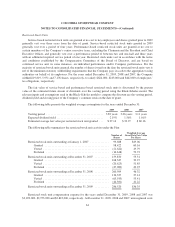

NOTE 16—FINANCIAL INSTRUMENTS AND RISK MANAGEMENT

In the normal course of business, the Company’s financial position and results of operations are routinely

subject to a variety of risks, including market risk associated with interest rate movements on borrowings and

investments and currency rate movements on non-functional currency denominated assets, liabilities and income.

The Company regularly assesses these risks and has established policies and business practices that serve to

mitigate these potential exposures. As part of the Company’s risk management programs, the Company may use

a variety of financial instruments, including foreign currency option and forward contracts. The Company does

not hold or issue derivative financial instruments for trading or speculative purposes.

The Company’s foreign currency risk management objective is to mitigate the uncertainty of anticipated

cash flows attributable to changes in exchange rates. Particular focus is put on cash flows resulting from

anticipated inventory purchases and the related receivables and payables, including third party or intercompany

transactions. The Company manages this risk primarily by using currency forward exchange contracts and

options. Anticipated transactions that are hedged carry a high level of certainty and are expected to be recognized

within one year. In addition, the Company may use cross-currency swaps to hedge foreign currency denominated

payments related to intercompany loan agreements.

The Company hedges against the exchange rate risk associated with anticipated transactions denominated in

non-functional currencies and accounts for these instruments as cash flow hedges. The effective change in fair

value of these financial instruments is initially offset to accumulated other comprehensive income and any

ineffective portion offset to current income. Amounts accumulated in other comprehensive income are

subsequently reclassified to cost of sales when the underlying transaction is included in income. Hedge

effectiveness is determined by evaluating the ability of a hedging instrument’s cumulative change in fair value to

offset the cumulative change in the present value of expected cash flows on the underlying exposures. For

forward contracts and options, the change in fair value attributable to changes in forward points and time value,

respectively, are excluded from the determination of hedge effectiveness and included in current cost of sales.

Hedge ineffectiveness was not material during the years ended December 31, 2009, 2008 and 2007. The

Company did not discontinue any material cash flow hedging relationships during the years ended December 31,

2009, 2008 and 2007 because it remained probable that the forecasted transactions would occur by the end of the

specified period.

65