Columbia Sportswear 2009 Annual Report Download - page 51

Download and view the complete annual report

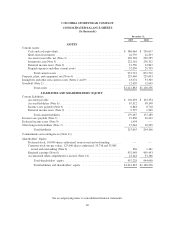

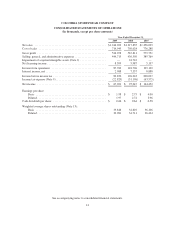

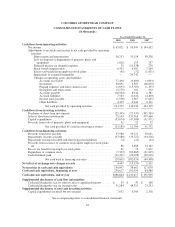

Please find page 51 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

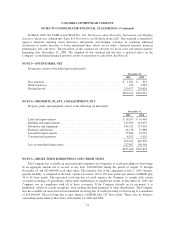

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS

NOTE 1—BASIS OF PRESENTATION AND ORGANIZATION

Nature of the business:

Columbia Sportswear Company is a global leader in the design, development, marketing and distribution of

active outdoor apparel, including sportswear, outerwear, footwear, accessories and equipment.

Principles of consolidation:

The consolidated financial statements include the accounts of Columbia Sportswear Company and its

wholly-owned subsidiaries (the “Company”). All significant intercompany balances and transactions have been

eliminated in consolidation.

Estimates and assumptions:

The preparation of financial statements in conformity with accounting principles generally accepted in the

United States of America requires management to make estimates and assumptions that affect the reported

amounts of assets and liabilities and disclosure of contingent assets and liabilities at the date of the consolidated

financial statements and the reported amounts of revenues and expenses during the reporting period. Actual

results may differ from these estimates and assumptions. Some of these more significant estimates relate to

revenue recognition, allowance for doubtful accounts, inventory, product warranty, long-lived and intangible

assets and income taxes.

Reclassifications:

Certain immaterial reclassifications of amounts reported in the prior period financial statements have been

made to conform to classifications used in the current period financial statements.

Dependence on key suppliers:

The Company’s products are produced by independent factories worldwide. For 2009, the Company sourced

nearly all of its products outside the United States, principally in the Southeast Asia. In 2009, the Company’s

four largest apparel factory groups accounted for approximately 15% of the Company’s total global apparel

production and the Company’s four largest footwear factory groups accounted for approximately 66% of the

Company’s total global footwear production. In addition, a single vendor supplied substantially all of the zippers

used in the Company’s products in 2009. From time to time, the Company has had difficulty satisfying its raw

material and finished goods requirements. Although the Company believes that it can identify and qualify

additional raw material suppliers and independent factories to produce these products, the unavailability of some

existing suppliers or independent factories for supply of these products may have a material adverse effect on the

Company.

Concentration of credit risk:

Trade Receivables

At December 31, 2009, the Company had one customer in its Canadian segment that accounted for

approximately 15.5% of consolidated accounts receivable. At December 31, 2008, the Company had one

customer in its EMEA segment and one customer in its Canadian segment that accounted for approximately

13.5% and 10.2% of consolidated accounts receivable, respectively. No single customer accounted for 10% or

more of consolidated revenues for any of the years ended December 31, 2009, 2008 or 2007.

44