Columbia Sportswear 2009 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

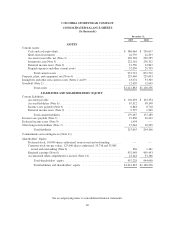

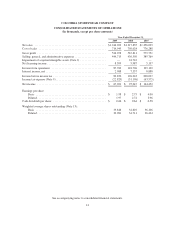

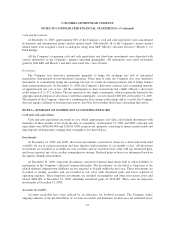

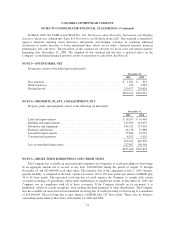

COLUMBIA SPORTSWEAR COMPANY

CONSOLIDATED STATEMENTS OF SHAREHOLDERS’ EQUITY

(In thousands)

Common Stock

Retained

Earnings

Accumulated

Other

Comprehensive

Income

Comprehensive

Income Total

Shares

Outstanding Amount

BALANCE, JANUARY 1, 2007 .......... 35,998 $ 24,370 $771,939 $ 34,394 $830,703

Components of comprehensive income:

Net income ....................... — — 144,452 — $144,452 144,452

Cash dividends ($0.58 per share) ...... — — (20,915) — — (20,915)

Foreign currency translation

adjustment ...................... — — — 25,394 25,394 25,394

Unrealized holding loss on derivative

transactions, net .................. — — — (2,147) (2,147) (2,147)

Comprehensive income .................. — — — — $167,699 —

Issuance of common stock under employee

stock plans, net ...................... 416 14,162 — — 14,162

Tax benefit from stock plans .............. — 3,031 — — 3,031

Stock-based compensation expense ........ — 7,260 — — 7,260

Repurchase of common stock ............. (590) (31,819) — — (31,819)

BALANCE, DECEMBER 31, 2007 ....... 35,824 17,004 895,476 57,641 970,121

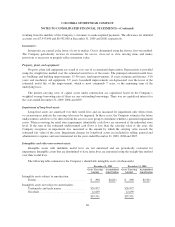

Components of comprehensive income:

Net income ....................... — — 95,047 — $ 95,047 95,047

Cash dividends ($0.64 per share) ...... — — (22,098) — — (22,098)

Foreign currency translation

adjustment ...................... — — — (30,511) (30,511) (30,511)

Unrealized holding gain on derivative

transactions, net .................. — — — 6,036 6,036 6,036

Comprehensive income .................. — — — — $ 70,572 —

Issuance of common stock under employee

stock plans, net ...................... 131 3,488 — — 3,488

Tax adjustment from stock plans .......... — (430) — — (430)

Stock-based compensation expense ........ — 6,302 — — 6,302

Repurchase of common stock ............. (2,090) (24,883) (58,982) — (83,865)

BALANCE, DECEMBER 31, 2008 ....... 33,865 1,481 909,443 33,166 944,090

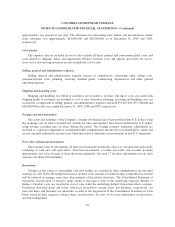

Components of comprehensive income:

Net income ....................... — — 67,021 — $ 67,021 67,021

Cash dividends ($0.66 per share) ...... — — (22,331) — — (22,331)

Unrealized holding gains on

available-for-sales securities, net .... — — — 64 64 64

Foreign currency translation

adjustment ...................... — — — 13,854 13,854 13,854

Unrealized holding loss on derivative

transactions, net .................. — — — (3,640) (3,640) (3,640)

Comprehensive income .................. — — — — $ 77,299 —

Issuance of common stock under employee

stock plans, net ...................... 75 86 — — 86

Tax adjustment from stock plans .......... — (870) — — (870)

Stock-based compensation expense ........ — 6,353 — — 6,353

Repurchase of common stock ............. (204) (6,214) (1,185) — (7,399)

BALANCE, DECEMBER 31, 2009 ....... 33,736 $ 836 $952,948 $ 43,444 $997,228

See accompanying notes to consolidated financial statements.

43