Columbia Sportswear 2009 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

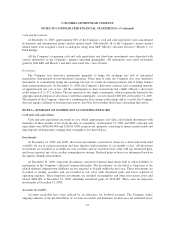

Stock-based compensation:

Stock-based compensation cost is estimated at the grant date based on the award’s fair value and is

recognized as expense over the requisite service period using the straight-line attribution method. The Company

estimates stock-based compensation for stock options granted using the Black-Scholes option pricing model,

which requires various highly subjective assumptions, including volatility and expected option life. Further, the

Company estimates forfeitures for stock-based awards granted, which are not expected to vest. If any of these

inputs or assumptions changes significantly, stock-based compensation expense may differ materially in the

future from that recorded in the current period.

Advertising costs:

Advertising costs are expensed in the period incurred and are included in selling, general and administrative

expenses. Total advertising expense, including cooperative advertising costs, was $65,204,000, $72,237,000 and

$55,290,000 for the years ended December 31, 2009, 2008 and 2007, respectively.

Through cooperative advertising programs, the Company reimburses its wholesale customers for some of

their costs of advertising the Company’s products based on various criteria, including the value of purchases

from the Company and various advertising specifications. Cooperative advertising costs are included in expenses

because the Company receives an identifiable benefit in exchange for the cost, the advertising may be obtained

from a party other than the customer, and the fair value of the advertising benefit can be reasonably estimated.

Cooperative advertising costs were $10,978,000, $16,351,000 and $17,884,000 for the years ended December 31,

2009, 2008 and 2007, respectively.

Product warranty:

Some of the Company’s products carry limited warranty provisions for defects in quality and workmanship.

A warranty reserve is established at the time of sale to cover estimated costs based on the Company’s history of

warranty repairs and replacements and is recorded in cost of sales. The reserve for warranty claims at

December 31, 2009 and 2008 was $12,112,000 and $9,746,000, respectively.

Recent Accounting Pronouncements:

In June 2009, the Financial Accounting Standards Board (“FASB”) issued SFAS No. 168, The FASB

Accounting Standards Codification™and the Hierarchy of Generally Accepted Accounting Principles, as

amended, which was codified into Topic 105 Generally Accepted Accounting Standards in the ASC. This

standard establishes the FASB ASC as the source of authoritative accounting principles recognized by the FASB

to be applied in the preparation of financial statements in conformity with generally accepted accounting

principles. This standard is effective for interim and annual financial periods ending after September 15,

2009. The adoption of this standard did not have a material effect on the Company’s consolidated financial

position, results of operations or cash flows.

In May 2009, the FASB issued SFAS No. 165, Subsequent Events, which was codified into Topic 855

Subsequent Events in the ASC and updated by Accounting Standards Update No. 2010-09, Amendments to

Certain Recognition and Disclosure Requirements. This guidance establishes general standards of evaluating and

accounting for events that occur after the balance sheet date but before financial statements are issued or are

available to be issued. This standard is effective for interim or annual financial periods ending after June 15,

2009. The adoption of this standard did not have a material effect on the Company’s consolidated financial

position, results of operations or cash flows.

50