Columbia Sportswear 2009 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

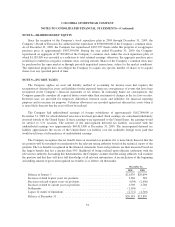

NOTE 8—SHAREHOLDERS’ EQUITY

Since the inception of the Company’s stock repurchase plan in 2004 through December 31, 2009, the

Company’s Board of Directors has authorized the repurchase of $500,000,000 of the Company’s common stock.

As of December 31, 2009, the Company has repurchased 8,897,957 shares under this program at an aggregate

purchase price of approximately $407,399,000. During the year ended December 31, 2009, the Company

repurchased an aggregate of $7,399,000 of the Company’s common stock under the stock repurchase plan, of

which $1,185,000 was recorded as a reduction to total retained earnings; otherwise, the aggregate purchase price

would have resulted in a negative common stock carrying amount. Shares of the Company’s common stock may

be purchased in the open market or through privately negotiated transactions, subject to the market conditions.

The repurchase program does not obligate the Company to acquire any specific number of shares or to acquire

shares over any specified period of time.

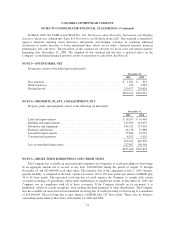

NOTE 9—INCOME TAXES

The Company applies an asset and liability method of accounting for income taxes that requires the

recognition of deferred tax assets and liabilities for the expected future tax consequences of events that have been

recognized in the Company’s financial statements or tax returns. In estimating future tax consequences, the

Company generally considers all expected future events other than enactment of changes in the tax laws or rates.

Deferred taxes are provided for temporary differences between assets and liabilities for financial reporting

purposes and for income tax purposes. Valuation allowances are recorded against net deferred tax assets when it

is more likely than not that the asset will not be realized.

The Company had undistributed earnings of foreign subsidiaries of approximately $162,784,000 at

December 31, 2009 for which deferred taxes have not been provided. Such earnings are considered indefinitely

invested outside of the United States. If these earnings were repatriated to the United States, the earnings would

be subject to U.S. taxation. The amount of the unrecognized deferred tax liability associated with the

undistributed earnings was approximately $40,011,000 at December 31, 2009. The unrecognized deferred tax

liability approximates the excess of the United States tax liability over the creditable foreign taxes paid that

would result from a full remittance of undistributed earnings.

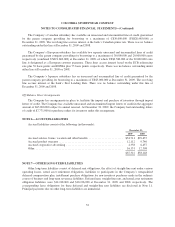

The Company recognizes the tax benefit from an uncertain tax position if it is more likely than not that the

tax position will be sustained on examination by the relevant taxing authority based on the technical merits of the

position. The tax benefits recognized in the financial statements from such positions are then measured based on

the largest benefit that has a greater than 50% likelihood of being realized upon ultimate settlement with the

relevant tax authority. In making this determination, the Company assumes that the taxing authority will examine

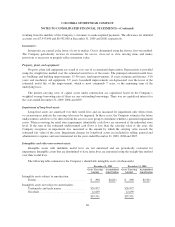

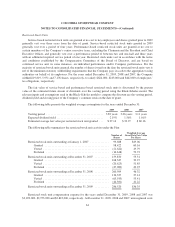

the position and that they will have full knowledge of all relevant information. A reconciliation of the beginning

and ending amount of gross unrecognized tax benefits is as follows (in thousands):

December 31,

2009 2008

Balance at January 1 ................................................. $21,839 $20,694

Increases related to prior years tax positions .............................. 1,346 583

Decreases related to prior years tax positions .............................. (634) (2,496)

Increases related to current year tax positions ............................. 1,598 4,768

Settlements ........................................................ (1,194) —

Lapses of statute of limitations ......................................... (2,772) (1,710)

Balance at December 31 .............................................. $20,183 $21,839

53