Columbia Sportswear 2009 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

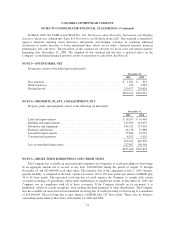

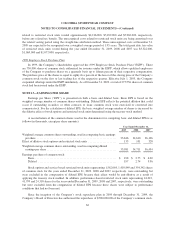

The Company’s Canadian subsidiary has available an unsecured and uncommitted line of credit guaranteed

by the parent company providing for borrowing to a maximum of C$30,000,000 (US$28,485,000) at

December 31, 2009. The revolving line accrues interest at the bank’s Canadian prime rate. There was no balance

outstanding under this line at December 31, 2009 and 2008.

The Company’s European subsidiary has available two separate unsecured and uncommitted lines of credit

guaranteed by the parent company providing for borrowing to a maximum of 30,000,000 and 20,000,000 euros

respectively (combined US$71,602,000) at December 31, 2009, of which US$3,580,000 of the 20,000,000 euro

line is designated as a European customs guarantee. These lines accrue interest based on the ECB refinancing

rate plus 50 basis points and EONIA plus 75 basis points, respectively. There was no balance outstanding under

either line at December 31, 2009 or 2008.

The Company’s Japanese subsidiary has an unsecured and uncommitted line of credit guaranteed by the

parent company providing for borrowing to a maximum of US$5,000,000 at December 31, 2009. The revolving

line accrues interest at the bank’s Best Lending Rate. There was no balance outstanding under this line at

December 31, 2009 and 2008.

Off-Balance Sheet Arrangements

The Company has arrangements in place to facilitate the import and purchase of inventory through import

letters of credit. The Company has available unsecured and uncommitted import letters of credit in the aggregate

amount of $65,000,000 subject to annual renewal. At December 31, 2009, the Company had outstanding letters

of credit of $7,771,000 for purchase orders for inventory under this arrangement.

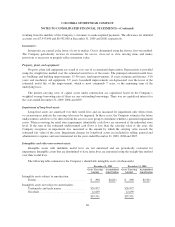

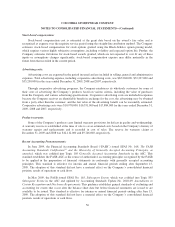

NOTE 6—ACCRUED LIABILITIES

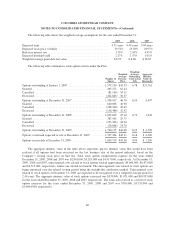

Accrued liabilities consist of the following (in thousands):

December 31,

2009 2008

Accrued salaries, bonus, vacation and other benefits ........................ $34,711 $29,437

Accrued product warranty ............................................. 12,112 9,746

Accrued cooperative advertising ........................................ 4,358 6,457

Other ............................................................. 16,131 12,508

$67,312 $58,148

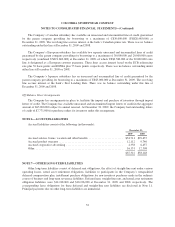

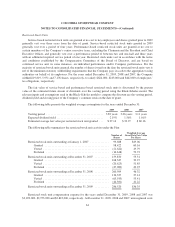

NOTE 7—OTHER LONG-TERM LIABILITIES

Other long-term liabilities consist of deferred rent obligations, the effect of straight-line rent under various

operating leases, rental asset retirement obligations, liabilities to participants in the Company’s nonqualified

deferred compensation plan, installment purchase obligations for non-inventory purchases made in the ordinary

course of business and long-term severance liabilities. Deferred rent, straight-line rent, and rental asset retirement

obligation liabilities were $14,218,000 and $10,126,000 at December 31, 2009 and 2008, respectively. The

corresponding lease obligations for these deferred and straight-line rent liabilities are disclosed in Note 11.

Principal payments due on other long-term liabilities are immaterial.

52