Columbia Sportswear 2009 Annual Report Download - page 36

Download and view the complete annual report

Please find page 36 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.Net sales of outerwear decreased $9.2 million, or 2%, to $482.5 million in 2009 from $491.7 million in

2008. The decrease in outerwear net sales consisted of decreased net sales in the EMEA direct and distributor

businesses, the LAAP distributor business, Canada and the United States wholesale business, partially offset by

increased net sales in our United States retail business, Japan and Korea. By brand, the decrease in net sales of

Columbia-branded outerwear was partially offset by increased net sales of Mountain Hardwear-branded

outerwear. We primarily attribute the decrease in wholesale net sales of Columbia-branded outerwear to lower

initial order volumes.

Net sales of footwear decreased $2.6 million, or 1%, to $214.6 million in 2009 from $217.2 million in 2008.

The decrease in footwear net sales was concentrated in the EMEA distributor business, followed by the United

States wholesale and LAAP distributor businesses, partially offset by increased net sales of footwear in our

United States retail business, Japan and Canada. Footwear net sales were essentially flat in the EMEA direct

business and Korea. By brand, the decrease in net sales of Columbia-branded footwear was partially offset by

increased net sales of Sorel-branded footwear. Net sales of Sorel-branded footwear increased in all regions and

businesses except the EMEA distributor business. The decrease in footwear net sales to EMEA distributors

primarily reflects lower Columbia-branded product net sales to our largest customer in that region and a shift in

the timing of shipments as a smaller percentage of spring 2010 shipments occurred in the fourth quarter of 2009,

while a higher percentage of spring 2009 shipments occurred in the fourth quarter of 2008.

Net sales of accessories and equipment increased $6.4 million, or 9%, to $74.4 million in 2009 from $68.0

million in 2008. Accessories and equipment sales growth was concentrated in Columbia-branded accessories and

equipment and led by the United States and the LAAP region, followed by Canada, partially offset by a decrease

in net sales in the EMEA region.

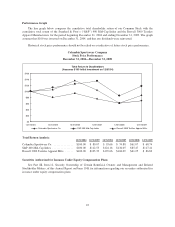

Sales by Geographic Region

Net sales in the United States increased $9.2 million, or 1%, to $736.9 million in 2009 from $727.7 million

in 2008. The increase in net sales in the United States was led by outerwear, followed by footwear and

accessories and equipment, partially offset by decreased net sales of sportswear. A net sales increase through our

retail channels was partially offset by a net sales decrease in our wholesale business. During 2009, we opened 11

new outlet retail stores in the United States, ending the year with 39 outlet retail stores and 6 branded retail

stores. In addition, we launched e-commerce websites for the Columbia brand in the third quarter of 2009 and for

the Sorel brand in the fourth quarter of 2009.

Net sales in the EMEA region decreased $69.8 million, or 26%, to $197.4 million in 2009 from $267.2

million in 2008. Changes in foreign currency exchange rates compared to 2008 negatively affected the net sales

comparison by three percentage points. The decrease in net sales in the EMEA region was led by sportswear and

outerwear, followed by footwear and accessories and equipment. Net sales decreased for both the EMEA

distributor and EMEA direct businesses. The decrease in net sales to EMEA distributors primarily reflects lower

Columbia-branded product net sales to our largest distributor in the region and a shift in the timing of shipments

as a smaller percentage of spring 2010 shipments occurred in the fourth quarter of 2009, while a higher

percentage of spring 2009 shipments occurred in the fourth quarter of 2008. The decrease in EMEA direct net

sales was consistent with lower advance order volumes due in part to continued product assortment and

marketing challenges.

Net sales in the LAAP region increased $5.0 million, or 3%, to $203.2 million in 2009 from $198.2 million

in 2008. Changes in foreign currency exchange rates contributed two percentage points of benefit to LAAP net

sales compared to 2008. The net sales increase in the LAAP region was led by outerwear, followed by

accessories and equipment and footwear, partially offset by a net sales decrease in sportswear. Net sales growth

in the LAAP region was led by our Japan business, which benefited from foreign currency exchange rates,

followed by our Korea business, partially offset by a net sales decrease in our LAAP distributor business.

29