Columbia Sportswear 2009 Annual Report Download - page 38

Download and view the complete annual report

Please find page 38 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.licensing in the LAAP region. Products distributed by our licensees in 2009 included apparel, footwear, leather

accessories, eyewear, socks, insulated products including soft-sided coolers, camping gear, bicycles, home

products, luggage, watches and other accessories.

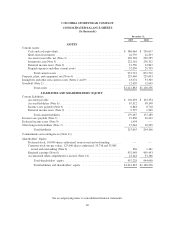

Interest Income, Net: Interest income was $2.1 million in 2009 compared to $7.6 million in 2008. The

decrease in interest income was almost entirely due to significantly lower interest rates in 2009 compared to

2008. Interest expense was nominal in 2009 and 2008.

Income Tax Expense: Our provision for income taxes decreased to $22.8 million in 2009 from $31.2

million in 2008. This decrease resulted from lower income before tax, partially offset by an increase in our

effective income tax rate to 25.4% in 2009 compared to 24.7% in 2008. Our 2009 effective tax rate varied from

the U.S. statutory rate due to foreign tax credits and the favorable settlement of uncertain tax positions.

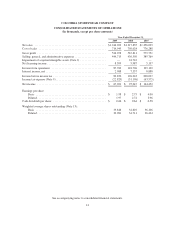

Year Ended December 31, 2008 Compared to Year Ended December 31, 2007

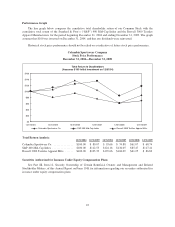

Net Sales: Consolidated net sales decreased $38.2 million, or 3%, to $1,317.8 million in 2008 from

$1,356.0 million in 2007. Changes in foreign currency exchange rates compared to 2007 contributed one

percentage point of benefit to the consolidated net sales comparison. The decrease in net sales was led by the

United States, followed by the EMEA region and Canada, partially offset by increased net sales in the LAAP

region. By product category, the reduction in net sales was led by sportswear, followed by footwear and

outerwear, partially offset by increased net sales of accessories and equipment.

Sales by Product Category

Net sales of sportswear decreased $24.7 million, or 4%, to $540.9 million in 2008 from $565.6 million in

2007. The decrease in sportswear net sales was predominantly the result of decreased net sales in the United

States, followed by the EMEA region, offset by increased net sales in the LAAP region and Canada. The

sportswear net sales decrease was led by the United States wholesale business for the Columbia brand, partially

offset by incremental net sales through our expanded base of branded and outlet retail stores. We primarily

attribute the decrease in wholesale net sales of sportswear to the lower initial order volumes and the weak U.S.

retail environment resulting from difficult macro-economic conditions.

Net sales of outerwear decreased $5.9 million, or 1%, to $491.7 million in 2008 from $497.6 million in

2007. The decrease in outerwear net sales was led by the United States, followed by the EMEA region and

Canada, partially offset by an increase in the LAAP region. The decrease in outerwear net sales was

predominantly the result of decreased sales of the Columbia brand in the United States wholesale and EMEA

direct businesses. The decrease in both regions was primarily the result of lower initial order volumes for the

spring and fall 2008 seasons as well as the weak retail environment resulting from difficult macro-economic

conditions. The decrease in sales of Columbia-branded outerwear was partially offset by increased sales of

Mountain Hardwear-branded outerwear.

Net sales of footwear decreased $10.2 million, or 4%, to $217.2 million in 2008 from $227.4 million in

2007. The decrease in footwear net sales was led by the EMEA region, followed by Canada, partially offset by

increased net sales of footwear in the LAAP region and the United States. The decrease in footwear net sales in

the EMEA region was led by EMEA direct footwear net sales, followed by EMEA distributor net sales. The

decrease in EMEA direct footwear net sales was primarily the result of lower initial order volumes due to

continued product assortment and marketing challenges, coupled with economic uncertainty in that region. The

decrease in EMEA distributor footwear net sales was primarily a result of earlier shipments of spring 2008

product that occurred in the fourth quarter of 2007.

Net sales of accessories and equipment increased $2.6 million, or 4%, to $68.0 million in 2008 from $65.4

million in 2007. Accessories and equipment sales growth was led by the LAAP region, followed by Canada,

partially offset by a decrease in net sales in the United States, while net sales of accessories and equipment

remained flat in the EMEA region.

31