Columbia Sportswear 2009 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

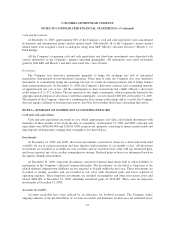

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

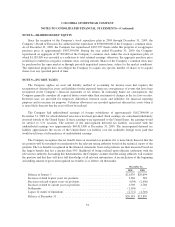

Cash and Investments

At December 31, 2009, approximately 80% of the Company’s cash and cash equivalents were concentrated

in domestic and international money market mutual funds. Substantially all of the Company’s money market

mutual funds were assigned a AAA or analogous rating from S&P, Moody’s Investor Services (“Moody’s”) or

Fitch Ratings.

All the Company’s remaining cash and cash equivalents and short-term investments were deposited with

various institutions in the Company’s primary operating geographies. All institutions were rated investment

grade by both S&P and Moody’s and most were rated AA- / Aa1 or better.

Derivatives

The Company uses derivative instruments primarily to hedge the exchange rate risk of anticipated

transactions denominated in non-functional currencies. From time to time, the Company also uses derivative

instruments to economically hedge the exchange rate risk of certain investment positions and to hedge balance

sheet remeasurement risk. At December 31, 2009, the Company’s derivative contracts had a remaining maturity

of approximately one year or less. All the counterparties to these transactions had a S&P / Moody’s short-term

credit rating of A-2 / P-2 or better. The net exposure to any single counterparty, which is generally limited to the

aggregate unrealized gain of all contracts with that counterparty, was less than $1,000,000 at December 31, 2009.

The majority of the Company’s derivative counterparties have strong credit ratings and as a result, the Company

does not require collateral to facilitate transactions. See Note 16 for further disclosures concerning derivatives.

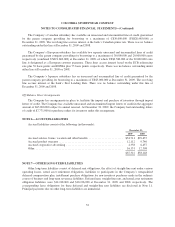

NOTE 2—SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Cash and cash equivalents:

Cash and cash equivalents are stated at cost, which approximates fair value, and include investments with

maturities of three months or less from the date of acquisition. At December 31, 2009 and 2008, cash and cash

equivalents were $386,664,000 and $230,617,000, respectively, primarily consisting of money market funds and

time deposits with maturities ranging from overnight to less than 90 days.

Investments:

At December 31, 2009 and 2008, short-term investments consisted of shares in a short-term bond fund

available for use in current operations and time deposits with maturities of six months or less. All short-term

investments are classified as available-for-sale securities and are recorded at fair value with any unrealized gains

and losses reported, net of tax, in other comprehensive income. Realized gains or losses are determined based on

the specific identification method.

At December 31, 2009, long-term investments consisted of mutual fund shares held to offset liabilities to

participants in the Company’s deferred compensation plan. The investments are classified as long-term as the

related deferred compensation liabilities are not expected to be paid within the next year. These investments are

classified as trading securities and are recorded at fair value with unrealized gains and losses reported in

operating expenses. These long-term investments are included in intangibles and other non-current assets and

totaled $826,000 at December 31, 2009, including unrealized gains of $130,000. There were no long-term

investments at December 31, 2008.

Accounts receivable:

Accounts receivable have been reduced by an allowance for doubtful accounts. The Company makes

ongoing estimates of the uncollectibility of accounts receivable and maintains an allowance for estimated losses

45