Columbia Sportswear 2009 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

In March 2008, the FASB issued SFAS No. 161, Disclosures about Derivative Instruments and Hedging

Activities, which was codified into Topic 815 Derivatives and Hedging in the ASC.This standard is intended to

improve financial reporting about derivative instruments and hedging activities by requiring enhanced

disclosures to enable investors to better understand their effects on an entity’s financial position, financial

performance and cash flows. The provisions of this standard are effective for fiscal years and interim quarters

beginning after November 15, 2008. The adoption of this standard did not have a material effect on the

Company’s consolidated financial position, results of operations or cash flows. See Note 16.

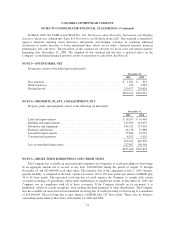

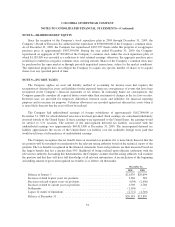

NOTE 3—INVENTORIES, NET

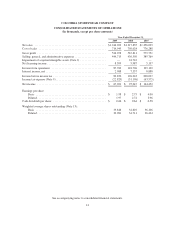

Inventories consist of the following (in thousands):

December 31,

2009 2008

Raw materials .................................................... $ 1,021 $ 621

Work in process ................................................... 163 1,065

Finished goods .................................................... 220,977 254,626

$222,161 $256,312

NOTE 4—PROPERTY, PLANT, AND EQUIPMENT, NET

Property, plant, and equipment consist of the following (in thousands):

December 31,

2009 2008

Land and improvements ............................................ $ 16,557 $ 16,465

Building and improvements ......................................... 147,093 143,997

Machinery and equipment ........................................... 184,721 171,091

Furniture and fixtures .............................................. 44,158 37,886

Leasehold improvements ............................................ 57,866 45,231

Construction in progress ............................................ 8,932 5,929

459,327 420,599

Less accumulated depreciation ....................................... 223,887 190,906

$235,440 $229,693

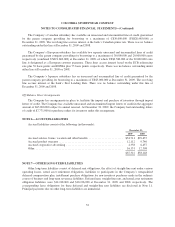

NOTE 5—SHORT-TERM BORROWINGS AND CREDIT LINES

The Company has available an unsecured and committed revolving line of credit providing for borrowings

in an aggregate amount not to exceed, at any time, $100,000,000 during the period of August 15 through

November 14 and $25,000,000 at all other times. The maturity date of this agreement is July 1, 2010. Interest,

payable monthly, is computed at the bank’s prime rate minus 195 to 205 basis points per annum or LIBOR plus

45 to 65 basis points. The unsecured revolving line of credit requires the Company to comply with certain

covenants including a Capital Ratio, which limits indebtedness to tangible net worth. At December 31, 2009, the

Company was in compliance with all of these covenants. If the Company defaults on its payments, it is

prohibited, subject to certain exceptions, from making dividend payments or other distributions. The Company

also has available an unsecured and uncommitted revolving line of credit providing for borrowing to a maximum

of $25,000,000. The revolving line accrues interest at LIBOR plus 125 basis points. There were no balances

outstanding under either of these lines at December 31, 2009 and 2008.

51