Columbia Sportswear 2009 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

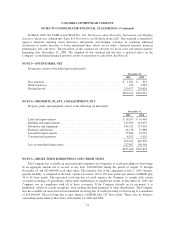

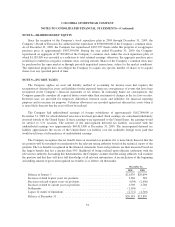

Amortization expense for the years ended December 31, 2009, 2008, and 2007 was $109,000, $205,000 and

$175,000, respectively. Amortization expense for patents is estimated to be $109,000 in 2010 and $73,000 per

year in 2011 and 2012. These patents are anticipated to become fully amortized in 2012.

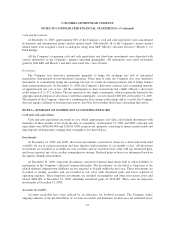

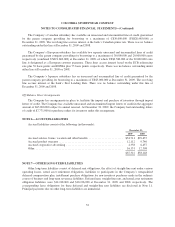

Other non-current assets consisted of the following (in thousands):

December 31,

2009 2008

Deferred tax assets ................................................... $ 5,435 $ 723

Long-term deposits ................................................... 8,360 4,483

Other .............................................................. 2,150 923

$15,945 $6,129

Impairment of goodwill and intangible assets:

Goodwill and intangible assets with indefinite useful lives are not amortized but instead are measured for

impairment. The Company reviews and tests its goodwill and intangible assets with indefinite useful lives for

impairment in the fourth quarter of each year and when events or changes in circumstances indicate that the

carrying amount of such assets may be impaired. The Company’s intangible assets with indefinite lives consist of

trademarks and trade names. Substantially all of the Company’s goodwill is recorded in the United States

segment and impairment testing for goodwill is performed at the reporting unit level. The two-step process first

compares the estimated fair value of reporting unit goodwill with the carrying amount of that reporting unit. The

Company estimates the fair value of its reporting units using a combination of discounted cash flow analysis,

comparisons with the market values of similar publicly traded companies and other operating performance based

valuation methods. If step one indicates impairment, step two compares the estimated fair value of the reporting

unit to the estimated fair value of all reporting unit assets and liabilities except goodwill to determine the implied

fair value of goodwill. The Company calculates impairment as the excess of carrying amount of goodwill over

the implied fair value of goodwill. In the impairment test for trademarks, the Company compares the estimated

fair value of the asset to the carrying amount. The fair value of trademarks is estimated using the relief from

royalty approach, a standard form of discounted cash flow analysis used in the valuation of trademarks. If the

carrying amount of trademarks exceeds the estimated fair value, the Company calculates impairment as the

excess of carrying amount over the estimate of fair value. Impairment charges are classified as a component of

operating expense. The fair value estimates are based on a number of factors, including assumptions and

estimates for projected sales, income, cash flows, discount rates and other operating performance measures.

Changes in estimates or the application of alternative assumptions could produce significantly different results.

These assumptions and estimates may change in the future due to changes in economic conditions, changes in the

Company’s ability to meet sales and profitability objectives or changes in the Company’s business operations or

strategic direction.

Intangible assets that are determined to have finite lives are amortized over their useful lives and are

measured for impairment only when events or circumstances indicate the carrying value may be impaired. In

these cases, the Company estimates the future undiscounted cash flows to be derived from the asset or asset

group to determine whether a potential impairment exists. If the sum of the estimated undiscounted cash flows is

less than the carrying value of the asset the Company recognizes an impairment loss, measured as the amount by

which the carrying value exceeds the estimated fair value of the asset. Impairment charges are classified as a

component of operating expense.

At December 31, 2009, the Company determined that its goodwill and intangible assets were not impaired.

At December 31, 2008, the Company determined that its Pacific Trail brand and Montrail brand goodwill and

47