Columbia Sportswear 2009 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

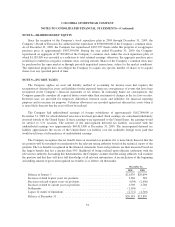

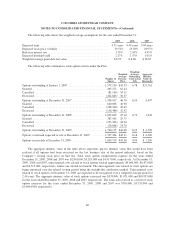

The following table shows the weighted average assumptions for the year ended December 31:

2009 2008 2007

Expected term ................................................ 4.71 years 4.43 years 5.04 years

Expected stock price volatility .................................... 29.52% 25.03% 28.97%

Risk-free interest rate ........................................... 1.73% 2.54% 4.55%

Expected dividend yield ......................................... 2.17% 1.57% 1.01%

Weighted average grant date fair value ............................. $6.55 $ 8.60 $ 18.87

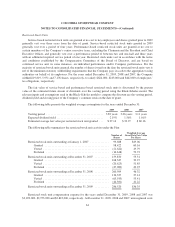

The following table summarizes stock option activity under the Plan:

Number of

Shares

Weighted

Average

Exercise

Price

Weighted

Average

Remaining

Contractual

Life

Aggregate

Intrinsic

Value (in

thousands)

Options outstanding at January 1, 2007 ......................... 1,579,150 $41.93 6.78 $21,761

Granted .................................................. 263,272 61.44

Cancelled ................................................ (81,160) 53.11

Exercised ................................................. (402,845) 36.37

Options outstanding at December 31, 2007 ...................... 1,358,417 46.70 6.54 4,497

Granted .................................................. 640,008 40.98

Cancelled ................................................ (228,300) 49.49

Exercised ................................................. (116,486) 32.42

Options outstanding at December 31, 2008 ...................... 1,653,639 45.10 6.73 1,042

Granted .................................................. 387,505 29.75

Cancelled ................................................ (252,303) 44.90

Exercised ................................................. (28,668) 24.76

Options outstanding at December 31, 2009 ...................... 1,760,173 $42.08 6.25 $ 4,599

Options vested and expected to vest at December 31, 2009 ......... 1,707,304 $42.31 6.18 $ 4,289

Options exercisable at December 31, 2009 ...................... 1,069,713 $45.56 4.94 $ 1,209

The aggregate intrinsic value in the table above represents pre-tax intrinsic value that would have been

realized if all options had been exercised on the last business day of the period indicated, based on the

Company’s closing stock price on that day. Total stock option compensation expense for the years ended

December 31, 2009, 2008 and 2007 was $2,861,000, $3,329,000 and $4,417,000, respectively. At December 31,

2009, 2008 and 2007, unrecognized costs related to stock options totaled approximately $4,609,000, $6,473,000

and $6,515,000, respectively, before any related tax benefit. The unrecognized costs related to stock options are

being amortized over the related vesting period using the straight-line attribution method. Unrecognized costs

related to stock options at December 31, 2009 are expected to be recognized over a weighted average period of

2.46 years. The aggregate intrinsic value of stock options exercised was $333,000, $1,071,000 and $10,953,000

for the years ended December 31, 2009, 2008 and 2007, respectively. The total cash received as a result of stock

option exercises for the years ended December 31, 2009, 2008 and 2007 was $710,000, $3,731,000 and

$14,604,000, respectively.

60