Columbia Sportswear 2009 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

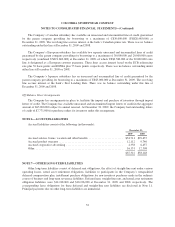

related to restricted stock units totaled approximately $4,216,000, $5,499,000 and $5,963,000, respectively,

before any related tax benefit. The unrecognized costs related to restricted stock units are being amortized over

the related vesting period using the straight-line attribution method. These unrecognized costs at December 31,

2009 are expected to be recognized over a weighted average period of 1.95 years. The total grant date fair value

of restricted stock units vested during the year ended December 31, 2009, 2008 and 2007 was $3,522,000,

$1,069,000 and $1,077,000, respectively.

1999 Employee Stock Purchase Plan

In 1999, the Company’s shareholders approved the 1999 Employee Stock Purchase Plan (“ESPP”). There

are 750,000 shares of common stock authorized for issuance under the ESPP, which allows qualified employees

of the Company to purchase shares on a quarterly basis up to fifteen percent of their respective compensation.

The purchase price of the shares is equal to eighty five percent of the lesser of the closing price of the Company’s

common stock on the first or last trading day of the respective quarter. Effective July 1, 2005, the Company

suspended offerings under the ESPP indefinitely. As of December 31, 2009, a total of 275,556 shares of common

stock had been issued under the ESPP.

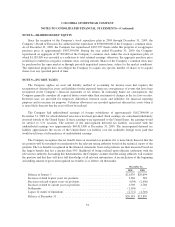

NOTE 13—EARNINGS PER SHARE

Earnings per Share (“EPS”),is presented on both a basic and diluted basis. Basic EPS is based on the

weighted average number of common shares outstanding. Diluted EPS reflects the potential dilution that could

occur if outstanding securities or other contracts to issue common stock were exercised or converted into

common stock. For the calculation of diluted EPS, the basic weighted average number of shares is increased by

the dilutive effect of stock options and restricted stock units determined using the treasury stock method.

A reconciliation of the common shares used in the denominator for computing basic and diluted EPS is as

follows (in thousands, except per share amounts):

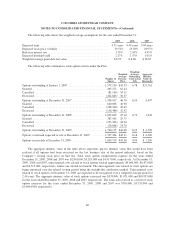

Year Ended December 31,

2009 2008 2007

Weighted average common shares outstanding, used in computing basic earnings

per share ........................................................ 33,846 34,610 36,106

Effect of dilutive stock options and restricted stock units .................... 135 101 328

Weighted-average common shares outstanding, used in computing diluted

earnings per share ................................................. 33,981 34,711 36,434

Earnings per share of common stock:

Basic ......................................................... $ 1.98 $ 2.75 $ 4.00

Diluted ....................................................... 1.97 2.74 3.96

Stock options and service-based restricted stock units representing 1,562,064, 1,410,849 and 354,342 shares

of common stock for the years ended December 31, 2009, 2008 and 2007, respectively, were outstanding but

were excluded in the computation of diluted EPS because their effect would be anti-dilutive as a result of

applying the treasury stock method. In addition, performance-based restricted stock units representing 44,043,

41,799 and 24,318 shares for the years ended December 31, 2009, 2008 and 2007, respectively, were outstanding

but were excluded from the computation of diluted EPS because these shares were subject to performance

conditions that had not been met.

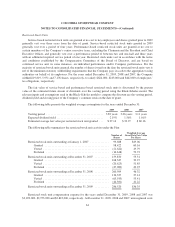

Since the inception of the Company’s stock repurchase plan in 2004 through December 31, 2009, the

Company’s Board of Directors has authorized the repurchase of $500,000,000 of the Company’s common stock.

62