Columbia Sportswear 2009 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

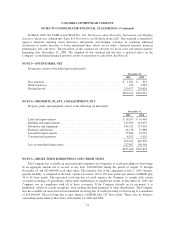

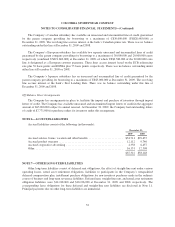

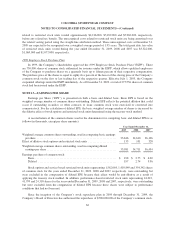

Significant components of the Company’s deferred taxes are as follows (in thousands):

December 31,

2009 2008

Deferred tax assets:

Non-deductible accruals and allowances ............................. $18,979 $14,886

Capitalized inventory costs ........................................ 15,326 14,703

Stock compensation .............................................. 5,399 4,857

Net operating loss carryforward .................................... 4,734 2,130

Depreciation and amortization ..................................... 582 972

Other ......................................................... 1,633 1,747

46,653 39,295

Valuation allowance ............................................. (5,163) (2,512)

Net deferred tax assets ............................................ 41,490 36,783

Deferred tax liabilities:

Deductible accruals and allowance .................................. (1,129) (1,396)

Depreciation and amortization ..................................... (4,624) —

Foreign currency loss ............................................ (1,475) (2,022)

Other ......................................................... (1,368) (744)

(8,596) (4,162)

Total ............................................................. $32,894 $32,621

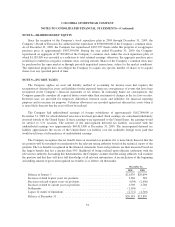

The Company had net operating loss carryforwards at December 31, 2009 and December 31, 2008 in certain

international tax jurisdictions of $50,338,000 and $27,191,000, respectively which will begin to expire in 2014.

The net operating losses result in a deferred tax asset at December 31, 2009 of $4,734,000, which was subject to

a $4,734,000 valuation allowance, and a deferred tax asset at December 31, 2008 of $2,130,000, which was

subject to a $2,130,000 valuation allowance. To the extent that the Company reverses a portion of the valuation

allowance, the adjustment would be recorded as a reduction to income tax expense.

Non-current deferred tax assets of $5,435,000 and $723,000 are included as a component of other

non-current assets in the consolidated balance sheet at December 31, 2009 and 2008, respectively.

NOTE 10—PROFIT SHARING PLANS

401(k) Profit-Sharing Plan

The Company has a 401(k) profit-sharing plan, which covers substantially all U.S. employees. Participation

begins the first of the quarter following completion of thirty days of service. The Company may elect to make

discretionary matching and/or non-matching contributions. All Company contributions to the plan as determined

by the Board of Directors totaled $2,610,000, $3,118,000 and $5,083,000 for the years ended December 31,

2009, 2008 and 2007, respectively.

Deferred Compensation Plan

The Company sponsors a nonqualified retirement savings plan for certain senior management employees

whose contributions to the tax qualified 401(k) plan would be limited by provisions of the Internal Revenue

Code. This plan allows participants to defer receipt of a portion of their salary and incentive compensation and to

56