Columbia Sportswear 2009 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

As of December 31, 2009, the Company has repurchased 8,897,957 shares under this program at an aggregate

purchase price of approximately $407,399,000. During the year ended December 31, 2009, the Company

repurchased an aggregate of $7,399,000 of the Company’s common stock under the stock repurchase plan, of

which $1,185,000 was recorded as a reduction to total retained earnings; otherwise, the aggregate purchase price

would have resulted in a negative common stock carrying amount. Shares of the Company’s common stock may

be purchased in the open market or through privately negotiated transactions, subject to the market conditions.

The repurchase program does not obligate the Company to acquire any specific number of shares or to acquire

shares over any specified period of time.

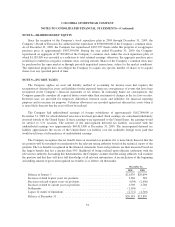

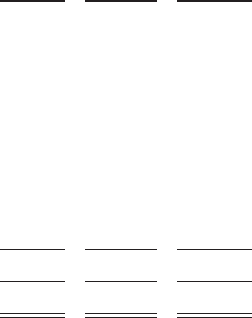

NOTE 14—COMPREHENSIVE INCOME

Accumulated other comprehensive income, net of applicable taxes, reported on the Company’s

Consolidated Balance Sheets consists of foreign currency translation adjustments, unrealized gains and losses on

derivative transactions and unrealized gains on available-for-sale securities. A summary of comprehensive

income, net of related tax effects, for the year ended December 31, is as follows (in thousands):

2009 2008 2007

Net income ...................................................... $67,021 $ 95,047 $144,452

Other comprehensive income (loss):

Unrealized holding gains on available-for-sale securities .............. 64 — —

Unrealized derivative holding gains (losses) arising during period (net of

tax expense (benefit) of ($1,054), $361 and ($796) in 2009, 2008 and

2007, respectively) .......................................... (3,024) 6,425 (844)

Reclassification to net income of previously deferred gains on derivative

transactions (net of tax benefit of $227, $36 and $608 in 2009, 2008 and

2007, respectively) .......................................... (616) (389) (1,303)

Foreign currency translation adjustments ........................... 13,854 (30,511) 25,394

Other comprehensive income (loss) ................................... 10,278 (24,475) 23,247

Comprehensive income ............................................. $77,299 $ 70,572 $167,699

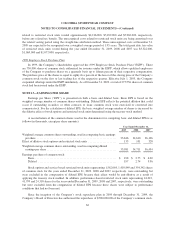

NOTE 15—SEGMENT INFORMATION

The Company operates in four geographic segments: (1) United States, (2) Europe, Middle East and Africa

(“EMEA”), (3) Latin America and Asia Pacific (“LAAP”), and (4) Canada, which are reflective of the

Company’s internal organization, management, and oversight structure. Each geographic segment operates

predominantly in one industry: the design, development, marketing and distribution of active outdoor apparel,

including sportswear, outerwear, footwear, accessories and equipment.

63