Columbia Sportswear 2009 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

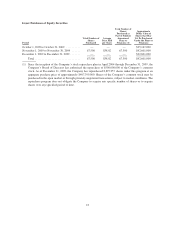

• Since the inception of our stock repurchase plan in 2004 through December 31, 2009, our Board of

Directors has authorized the repurchase of $500 million of our common stock. As of December 31,

2009, we have repurchased 8,897,957 shares under this program at an aggregate purchase price of

approximately $407.4 million. Shares of our common stock may be purchased in the open market or

through privately negotiated transactions, subject to market conditions. The repurchase program does

not obligate us to acquire any specific number of shares or to acquire shares over any specified period of

time.

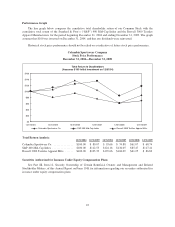

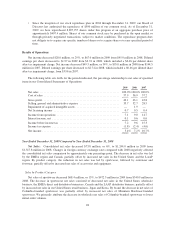

Results of Operations

Net income decreased $28.0 million, or 29%, to $67.0 million in 2009 from $95.0 million in 2008. Diluted

earnings per share decreased to $1.97 in 2009 from $2.74 in 2008, which included a $0.46 per diluted share

after-tax impairment charge. Net income decreased $49.5 million, or 34%, to $95.0 million in 2008 from $144.5

million in 2007. Diluted earnings per share decreased to $2.74 in 2008, which included a $0.46 per diluted share

after-tax impairment charge, from $3.96 in 2007.

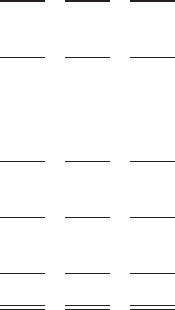

The following table sets forth, for the periods indicated, the percentage relationship to net sales of specified

items in our Consolidated Statements of Operations:

2009 2008 2007

Net sales ........................................................ 100.0% 100.0% 100.0%

Cost of sales ..................................................... 57.9 56.9 57.2

Gross profit ...................................................... 42.1 43.1 42.8

Selling, general and administrative expense ............................ 35.7 32.7 28.5

Impairment of acquired intangible assets ............................... — 1.9 —

Net licensing income .............................................. 0.7 0.5 0.4

Income from operations ............................................ 7.1 9.0 14.7

Interest income, net ............................................... 0.1 0.6 0.6

Income before income tax .......................................... 7.2 9.6 15.3

Income tax expense ............................................... (1.8) (2.4) (4.6)

Net income ...................................................... 5.4% 7.2% 10.7%

Year Ended December 31, 2009 Compared to Year Ended December 31, 2008

Net Sales: Consolidated net sales decreased $73.8 million, or 6%, to $1,244.0 million in 2009 from

$1,317.8 million in 2008. Changes in foreign currency exchange rates compared with 2008 negatively affected

the consolidated net sales comparison by approximately one percentage point. The decrease in net sales was led

by the EMEA region and Canada, partially offset by increased net sales in the United States and the LAAP

region. By product category, the reduction in net sales was led by sportswear, followed by outerwear and

footwear, partially offset by increased net sales of accessories and equipment.

Sales by Product Category

Net sales of sportswear decreased $68.4 million, or 13%, to $472.5 million in 2009 from $540.9 million in

2008. The decrease in sportswear net sales consisted of decreased net sales in the United States wholesale

business, the EMEA direct and distributor businesses, Canada and the LAAP distributor business, partially offset

by increased net sales in our United States retail business, Japan and Korea. By brand, the decrease in net sales of

Columbia-branded sportswear was partially offset by increased net sales of Mountain Hardwear-branded

sportswear. We primarily attribute the decrease in wholesale net sales of Columbia-branded sportswear to lower

initial order volumes.

28