Columbia Sportswear 2009 Annual Report Download - page 55

Download and view the complete annual report

Please find page 55 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.COLUMBIA SPORTSWEAR COMPANY

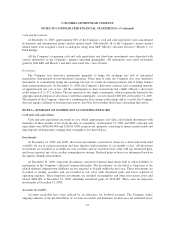

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

trademarks were impaired. These brands were not achieving their sales and profitability objectives. The

deterioration in the macroeconomic environment and the resulting effect on consumer demand decreased the

probability of realizing the objectives in the near future. These brands were acquired in 2006. For the year ended

December 31, 2008, the Company recorded impairment charges, before income taxes, of $12,250,000 in

trademarks and $3,900,000 in goodwill for the Pacific Trail brand. The Pacific Trail brand has $2,300,000 in

trademarks and no goodwill after the impairment charge. The Pacific Trail brand is a reporting unit for goodwill

impairment testing and Pacific Trail brand intangible assets are included in the United States segment. For the

year ended December 31, 2008, the Company recorded impairment charges, before income taxes, of $7,400,000

in trademarks, $714,000 in goodwill and $478,000 in patents for the Montrail brand. The Montrail brand has

$2,600,000 in trademarks and no goodwill or patents after the impairment charge. The Montrail brand is a

reporting unit for goodwill impairment testing and Montrail brand intangible assets are included in the United

States segment. Other than Pacific Trail brand goodwill and trademarks and Montrail brand goodwill, trademarks

and patents, at December 31, 2008, the Company determined that its goodwill and intangible assets were not

impaired.

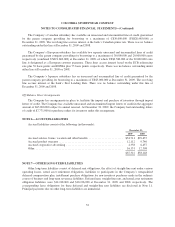

Deferred income taxes:

Income tax expense is provided at the U.S. tax rate on financial statement earnings, adjusted for the

difference between the U.S. tax rate and the rate of tax in effect for non-U.S. earnings deemed to be permanently

reinvested in the Company’s non-U.S. operations. Deferred income taxes have not been provided for the

potential remittance of non-U.S. undistributed earnings to the extent those earnings are deemed to be

permanently reinvested, or to the extent such recognition would result in a deferred tax asset. Deferred income

taxes are provided for the expected tax consequences of temporary differences between the tax bases of assets

and liabilities and their reported amounts. Valuation allowances are recorded to reduce deferred tax assets to the

amount that will more likely than not be realized.

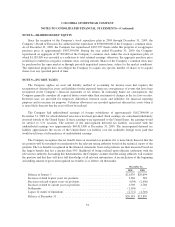

Revenue Recognition:

The Company records wholesale and licensed product revenues when title passes and the risks and rewards

of ownership have passed to the customer, based on the terms of sale. Title generally passes upon shipment to, or

upon receipt by, the customer depending on the country of the sale and the agreement with the customer. Retail

store revenues are recorded at the time of sale and e-commerce revenues are recorded upon shipment to the

customer.

In some countries outside of the United States where title passes upon receipt by the customer,

predominantly in the Company’s Western European wholesale business, precise information regarding the date

of receipt by the customer is not readily available. In these cases, the Company estimates the date of receipt by

the customer based on historical and expected delivery times by geographic location. The Company periodically

tests the accuracy of these estimates based on actual transactions. Delivery times vary by geographic location,

generally from one to five days. To date, the Company has found these estimates to be materially accurate.

At the time of revenue recognition, the Company also provides for estimated sales returns and

miscellaneous claims from customers as reductions to revenues. The estimates are based on historical rates of

product returns and claims. However, actual returns and claims in any future period are inherently uncertain and

thus may differ from the estimates. If actual or expected future returns and claims are significantly greater or

lower than the reserves that had been established, the Company would record a reduction or increase to net

revenues in the period in which it made such determination. Over the three year period ended December 31,

2009, the Company’s actual annual sales returns and miscellaneous claims from customers have averaged

48