Columbia Sportswear 2009 Annual Report Download - page 53

Download and view the complete annual report

Please find page 53 of the 2009 Columbia Sportswear annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

COLUMBIA SPORTSWEAR COMPANY

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS—(Continued)

resulting from the inability of the Company’s customers to make required payments. The allowance for doubtful

accounts was $7,347,000 and $9,542,000 at December 31, 2009 and 2008, respectively.

Inventories:

Inventories are carried at the lower of cost or market. Cost is determined using the first-in, first-out method.

The Company periodically reviews its inventories for excess, close-out or slow moving items and makes

provisions as necessary to properly reflect inventory value.

Property, plant, and equipment:

Property, plant and equipment are stated at cost, net of accumulated depreciation. Depreciation is provided

using the straight-line method over the estimated useful lives of the assets. The principal estimated useful lives

are: buildings and building improvements, 15-30 years; land improvements, 15 years; furniture and fixtures, 3-10

years; and machinery and equipment, 3-5 years. Leasehold improvements are depreciated over the lesser of the

estimated useful life of the improvement, which is most commonly 7 years, or the remaining term of the

underlying lease.

The interest-carrying costs of capital assets under construction are capitalized based on the Company’s

weighted average borrowing rates if there are any outstanding borrowings. There was no capitalized interest for

the years ended December 31, 2009, 2008 and 2007.

Impairment of long-lived assets:

Long-lived assets are amortized over their useful lives and are measured for impairment only when events

or circumstances indicate the carrying value may be impaired. In these cases, the Company estimates the future

undiscounted cash flows to be derived from the asset or asset group to determine whether a potential impairment

exists. When reviewing for retail store impairment, identifiable cash flows are measured at the individual store

level. If the sum of the estimated undiscounted cash flows is less than the carrying value of the asset, the

Company recognizes an impairment loss, measured as the amount by which the carrying value exceeds the

estimated fair value of the asset. Impairment charges for long-lived assets are included in selling, general and

administrative expense and were immaterial for the years ended December 31, 2009, 2008 and 2007.

Intangibles and other non-current assets:

Intangible assets with indefinite useful lives are not amortized and are periodically evaluated for

impairment. Intangible assets that are determined to have finite lives are amortized using the straight-line method

over their useful lives.

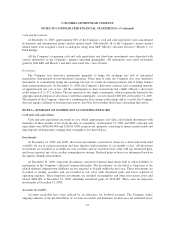

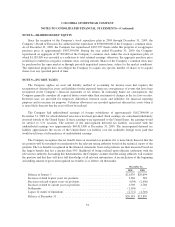

The following table summarizes the Company’s identifiable intangible assets (in thousands):

December 31, 2009 December 31, 2008

Gross Carrying

Amount

Accumulated

Amortization

Gross Carrying

Amount

Accumulated

Amortization

Intangible assets subject to amortization:

Patents ................................. $ 898 $(643) $ 898 $(534)

Intangible assets not subject to amortization:

Trademarks and trade names ................ $26,872 $26,872

Goodwill ............................... 12,659 12,659

$39,531 $39,531

46