Cisco 2005 Annual Report Download - page 64

Download and view the complete annual report

Please find page 64 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

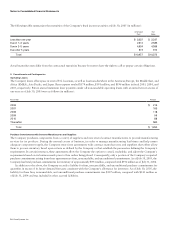

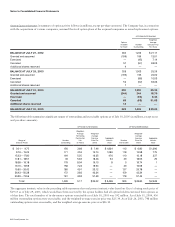

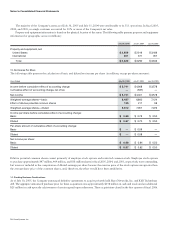

The items accounting for the difference between income taxes computed at the federal statutory rate and the provision for income

taxes consisted of the following:

July 30, 2005

35.0%

1.8

(0.5)

(8.1)

0.6

(0.3)

0.1

28.6%

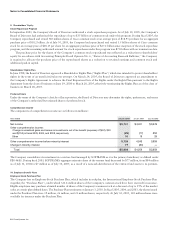

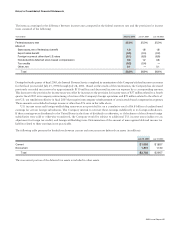

During the fourth quarter of fiscal 2005, the Internal Revenue Service completed its examination of the Company’s federal income tax returns

for the fiscal years ended July 25, 1998 through July 28, 2001. Based on the results of the examination, the Company has decreased

previously recorded tax reserves by approximately $110 million and decreased income tax expense by a corresponding amount.

This decrease to the provision for income taxes was offset by increases to the provision for income taxes of $57 million related to a fourth

quarter fiscal 2005 intercompany restructuring of certain of the Company’s foreign operations and $70 million related to the effects of

new U.S. tax regulations effective in fiscal 2005 that require intercompany reimbursement of certain stock-based compensation expenses.

These amounts are included in foreign income at other than U.S. rates in the table above.

U.S. income taxes and foreign withholding taxes were not provided for on a cumulative total of $6.8 billion of undistributed

earnings for certain foreign subsidiaries. The Company intends to reinvest these earnings indefinitely in its foreign subsidiaries.

If these earnings were distributed to the United States in the form of dividends or otherwise, or if the shares of the relevant foreign

subsidiaries were sold or otherwise transferred, the Company would be subject to additional U.S. income taxes (subject to an

adjustment for foreign tax credits) and foreign withholding taxes. Determination of the amount of unrecognized deferred income tax

liability related to these earnings is not practicable.

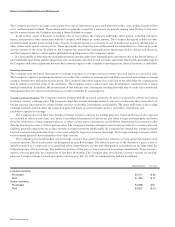

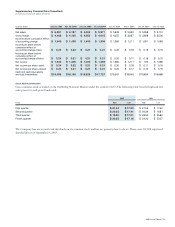

The following table presents the breakdown between current and noncurrent net deferred tax assets (in millions):

July 30, 2005

$ 1,582

1,201

$ 2,783

The noncurrent portion of the deferred tax assets is included in other assets.

Notes to Consolidated Financial Statements