Cisco 2005 Annual Report Download - page 10

Download and view the complete annual report

Please find page 10 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

13

Fiscal 2005 was a year of continued solid, balanced growth

for Cisco from both a product- and market-leadership per-

spective. We achieved an outstanding nancial performance

with record prots and cash generation, year-over-year

growth in our core routing and switching products, and

very strong growth in our six advanced technologies. Our

enterprise, service provider, and commercial customer mar-

ket segments all experienced solid year-over-year growth.

However, the highlight for the year was the balance that we

achieved across our geographies, customer market seg-

ments, architectural evolutions, and product families. We

believe our nancial strength, product leadership, and global

reach uniquely position Cisco as a company not only built to

last, but built to lead.

Innovation Strategy

In our opinion, the key to long-term suc-

cess in the high-technology industry

is ongoing strategic investment and

innovation, and we intend to continue to

take good business risks. Our innovation

strategy requires a unique combination

of internal development, partnerships,

and acquisitions. In our opinion, for

companies to lead in the technology

industry they must be able to do all

three. We continue to believe that our

industry will consolidate and that the

consolidation will occur along both

technology and business architecture

lines. This technology architecture will

probably evolve where the seven layers

of the Open Systems Interconnection

(OSI) stack are rst loosely, then tightly

coupled. That is exactly where you see

us taking the integration of our core and

advanced technology product archi-

tectures. Equally important, companies

also have to gain the condence of their

customers from a vision and strategy perspective, a product

architecture leadership perspective, and a service and sup-

port perspective. We think we are very uniquely positioned

to continue to win the hearts, minds, and capital investments

of our customers.

In scal 2005 we invested more than $3.3 billion in research

and development (R&D). This resulted in more than 50 product

introductions and the number-one market share leadership

position in most of our product categories, including our

advanced technology markets, truly demonstrating that the

investments we made three to ve years ago are now paying

off. We believe this product momentum will continue in scal

2006, and we will do our best to continue to meet and exceed

the expectations of our customers and partners.

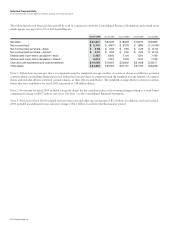

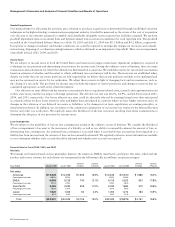

Fiscal 2005 Performance

In scal 2005 we achieved record performance across

almost all of our nancial and operational metrics. Fiscal 2005

revenue was $24.8 billion, compared to scal 2004 revenue

of $22.0 billion. Net income on a generally accepted account-

ing principles (GAAP) basis was $5.7 billion, compared to

scal 2004 GAAP net income of $4.4 billion. GAAP earnings

per share on a fully diluted basis for scal 2005 were $0.87,

compared to $0.62 for scal 2004. In

addition to net income, Cisco gener-

ated $7.6 billion in cash, highlighting the

ongoing quality of our earnings.

Cisco demonstrated solid execution on

its three long-term nancial priorities.

First, we continued to focus on prot-

able growth with GAAP net income as

a percentage of revenue exceeding

20 percent. During scal 2005, we in-

creased revenue year over year by

approximately 12.5 percent. Of total

revenue, approximately $20.9 billion was

related to product revenue and $3.9

billion was related to service revenue.

Our revenue growth is the result of a

continued recovery in the global IT eco-

nomic environment, and we achieved

signicant market share gains in many

product areas.

Second, we increased our protability.

We increased GAAP net income by 30

percent and GAAP earnings per share

by 40 percent during scal 2005, while

operating expenses decreased by 3

percent as a percentage of revenue.

A key competitive advantage for Cisco is how we use our own

technology to drive productivity. We achieved a key metric

by reaching our productivity goal of approximately $700,000

in annualized revenue per employee, up from approximately

$450,000 in scal 2001 when the goal was set. This is signi-

cant given that we also increased headcount in scal 2005

by 12 percent, primarily in sales and R&D. Our protability far

exceeded our revenue growth rate and is evidence of our

ability to drive productivity and operational efciency.