Cisco 2005 Annual Report Download - page 49

Download and view the complete annual report

Please find page 49 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Goodwill

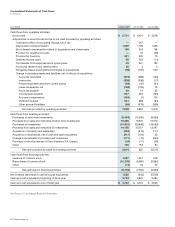

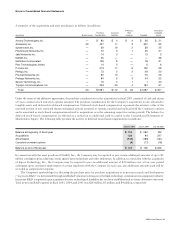

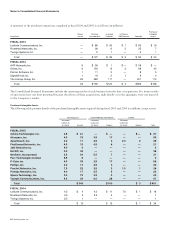

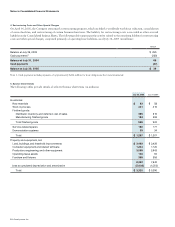

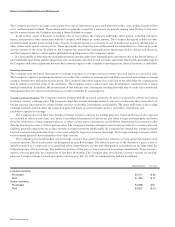

The following tables present the changes in goodwill allocated to the Company’s reportable segments during fiscal 2005 and 2004 (in millions):

Balance at

July 30, 2005

$ 3,323

978

266

728

$ 5,295

In fiscal 2005, the Company purchased a portion of the minority interest of Cisco Systems, K.K. (Japan). As a result, the Company

increased its ownership from 97.6% to 99.0% of the voting rights of Cisco Systems, K.K. (Japan) and recorded goodwill of $30 million,

which was included in the preceding table.

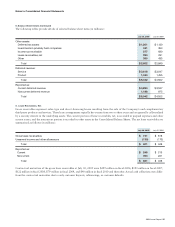

Acquisition of Variable Interest Entities

In April 2001, the Company entered into a commitment to provide convertible debt funding of approximately $84 million to Andiamo,

a privately held storage switch developer. This debt was convertible into approximately 44% of the equity of Andiamo. In connection

with this investment, the Company obtained a call option that provided the Company the right to purchase Andiamo. The purchase

price under the call option was based on a valuation of Andiamo using a negotiated formula. On August 19, 2002, the Company

entered into a definitive agreement to acquire Andiamo, which represented the exercise of its rights under the call option. The Company

also entered into a commitment to provide nonconvertible debt funding to Andiamo of approximately $100 million through the close

of the acquisition. Substantially all of the convertible debt funding of $84 million and nonconvertible debt funding of $100 million

was expensed as R&D costs.

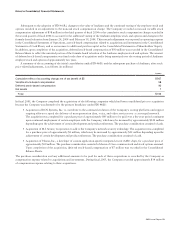

The Company adopted FIN 46(R) effective January 24, 2004. The Company evaluated its debt investment in Andiamo and

determined that Andiamo was a variable interest entity under FIN 46(R). The Company concluded that the Company was the primary

beneficiary as defined by FIN 46(R) and, therefore, accounted for Andiamo as if the Company had consolidated Andiamo since the

Company’s initial investment in April 2001. The consolidation of Andiamo from the date of the Company’s initial investment required

accounting for the call option as a repurchase right. Under FASB Interpretation No. 44, “Accounting for Certain Transactions Involving

Stock Compensation,” and related interpretations, variable accounting was required for substantially all Andiamo employee stock

and options because the ending purchase price was primarily derived from a revenue-based formula.

Effective January 24, 2004, the last day of the second quarter of fiscal 2004, the Company recorded a noncash cumulative stock

compensation charge of $567 million, net of tax (representing the amount of variable compensation from April 2001 through January

2004). This charge was reported as a separate line item in the Consolidated Statements of Operations as a cumulative effect of

accounting change, net of tax. The charge was based on the value of the Andiamo employee stock and options and their vesting from

the adoption of FIN 46(R) pursuant to the formula-based valuation.

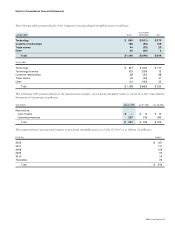

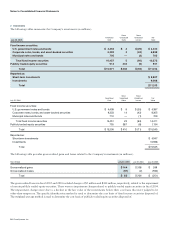

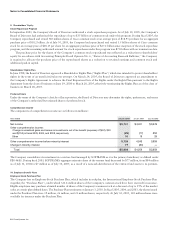

On February 19, 2004, the Company completed the acquisition of Andiamo, exchanging approximately 23 million shares of the

Company’s common stock for Andiamo shares not owned by the Company and assuming approximately 6 million stock options, for a

total estimated value of $750 million, primarily derived from the revenue-based formula, which after stock price-related adjustments

resulted in a total amount recorded of $722 million, as summarized in the table below.

Notes to Consolidated Financial Statements