Cisco 2005 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

31

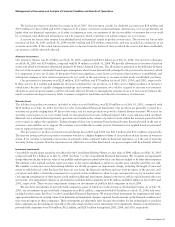

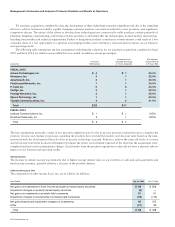

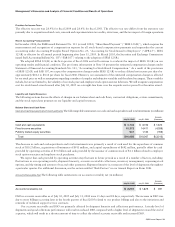

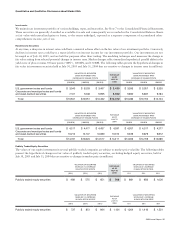

Net Product Sales by Groups of Similar Products

Routers The increase in net product sales related to routers was attributable to sales of high-end routers, which increased by $556 million

primarily as a result of higher spending by service providers, partially offset by a decline in sales of midrange routers and low-end routers,

which decreased by $47 million. The decrease in midrange and low-end routers was primarily due to the increased size of the default

memory in our basic configurations, which resulted in fewer customers needing to purchase lower-end routers to augment their memory.

Switches The increase in net product sales related to switches was primarily due to sales of LAN modular switches, which increased

by $694 million, and LAN fixed switches, which increased by $655 million, partially offset by sales of wide-area network (WAN)

switches, which decreased by $90 million. The increase in sales of LAN switches was a result of new technologies being implemented

by our customers, which resulted in higher sales of our modular switches, Cisco Catalyst 6500 Series and Catalyst 4500 Series, and

fixed-configuration switches, including the Cisco Catalyst 3750 Series, introduced in the fourth quarter of fiscal 2003, and the Cisco

Catalyst 3550 Series. The decline in sales of WAN switches was due to the continued technology migration away from Asynchronous

Transfer Mode (ATM) to IP.

Advanced Technologies The increase in net product sales related to advanced technologies was primarily due to sales of products in

all six of our advanced technology markets. Sales of our home networking products, which increased $605 million, were related to

our acquisition of the Linksys business in the fourth quarter of fiscal 2003. An increase of $228 million in sales of security products

was primarily due to module and line card sales related to our routers and switches as customers continued to emphasize network

security in light of continuing, well-publicized worms, viruses, and other attacks. Sales of enterprise IP communications products

increased $144 million primarily due to sales of IP phones and associated software related to the transition from analog to IP-based

infrastructure. Our wireless technology product sales increased $157 million due to sales of our access points as we gained new

customers and continued deployments with existing customers. Sales of storage area networking products, which increased $113

million, were related to our acquisition of Andiamo in the third quarter of fiscal 2004. See Note 3 to the Consolidated Financial

Statements. The increase of $85 million in sales of optical products was due to an increase in the sales of the Cisco ONS 15454 platform.

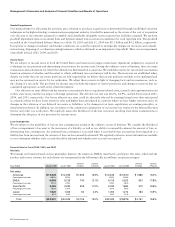

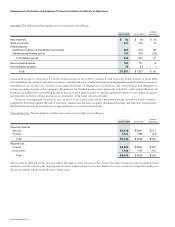

Net Service Revenue

The increase in net service revenue was primarily due to increased technical support service contract initiations and renewals associated

with higher product sales that have resulted in a larger installed base of equipment being serviced and revenue from advanced services,

which relates to consulting support services of our technologies for specific networking needs.

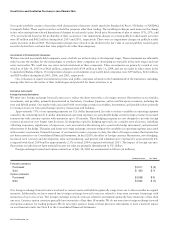

Product Gross Margin

Product gross margin decreased by 1.6%. Changes in the mix of products sold decreased product gross margin by approximately 3% due

to increased sales of home networking products related to our acquisition of the Linksys business and new product introductions

within our switching business. Product pricing reductions and sales discounts decreased product gross margin by approximately 1%,

and higher provision for inventory decreased product gross margin by 0.6%. However, lower manufacturing costs related to lower

component costs and value engineering and other manufacturing-related costs increased product gross margin by approximately

1.5%. Higher shipment volume also increased product gross margin by approximately 1.5%.

Service Gross Margin

Service gross margin decreased by 1.3% but increased $80 million in absolute dollars. Service gross margin will typically experience

some variability over time due to various factors such as the change in mix between technical support services and advanced services,

as well as the timing of technical support service contract initiations and renewals.

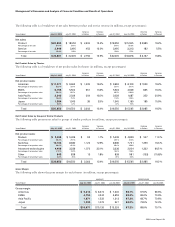

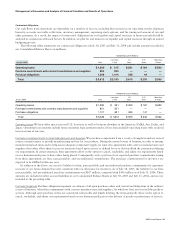

Research and Development, Sales and Marketing, and General and Administrative Expenses

R&D expenses increased primarily due to higher discretionary spending of $87 million, primarily related to higher prototype

expenses and due to an additional week of headcount-related expense of $28 million. The increase in R&D expenses was partially

offset by lower depreciation expense of $61 million. The increase in R&D expenses reflects our continued investment in R&D efforts

in routers, switches, advanced technologies, and other product technologies. In May 2004, we announced plans to hire additional engineers.

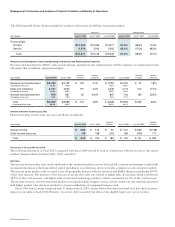

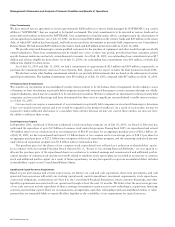

Management’s Discussion and Analysis of Financial Condition and Results of Operations