Cisco 2005 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

63

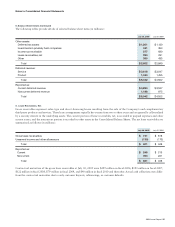

Employee Stock Option Plans

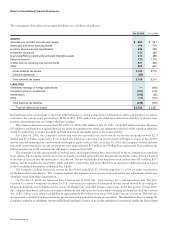

Stock Option Program Description The Company has two plans under which it grants options: the 1996 Stock Incentive Plan (the “1996 Plan”)

and the 1997 Supplemental Stock Incentive Plan (the “Supplemental Plan”).

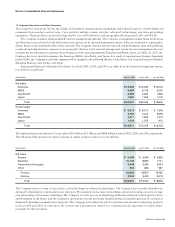

Stock option grants are designed to reward employees for their long-term contributions to the Company and provide incentives

for them to remain with the Company. The number and frequency of stock option grants are based on competitive practices, operating

results of the Company, and government regulations.

The maximum number of shares issuable over the term of the 1996 Plan is limited to 2.5 billion shares. Options granted under

the 1996 Plan have an exercise price equal to the fair market value of the underlying stock on the grant date and expire no later than

nine years from the grant date. The options will generally become exercisable for 20% or 25% of the option shares one year from

the date of grant and then ratably over the following 48 or 36 months, respectively. Certain other grants have utilized a 60-month

ratable vesting schedule. In addition, the Board of Directors, or other committee administering the plan, has the discretion to use a

different vesting schedule and has done so from time to time. Since the inception of the 1996 Plan, the Company has granted options

to virtually all employees, and the majority has been granted to employees below the vice president level.

In 1997, the Company adopted the Supplemental Plan, under which options can be granted or shares can be directly issued to

eligible employees. Officers and members of the Company’s Board of Directors are not eligible to participate in the Supplemental Plan.

Nine million shares have been reserved for issuance under the Supplemental Plan, of which 3 million options were granted. All option

grants have an exercise price equal to the fair market value of the underlying stock on the grant date. No shares were issued in fiscal

2005 under the Supplemental Plan, and the Company will no longer be issuing shares under the Supplemental Plan.

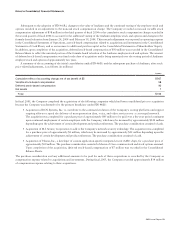

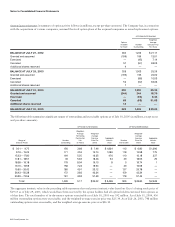

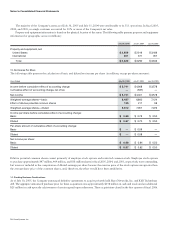

Distribution and Dilutive Effect of Options The following table illustrates the grant dilution and exercise dilution (in millions, except percentages):

July 30, 2005

6,331

244

(65)

179

2.8%

93

1.5%

Note 1: The percentage for grant dilution is computed based on net options granted as a percentage of shares of common stock outstanding.

Note 2: The percentage for exercise dilution is computed based on options exercised as a percentage of shares of common stock outstanding.

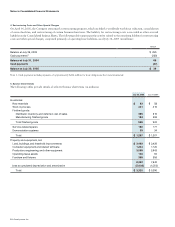

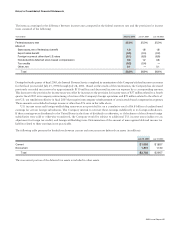

Basic and diluted shares outstanding for the year ended July 30, 2005 were 6.5 billion shares and 6.6 billion shares, respectively. Diluted

shares outstanding include the dilutive impact of in-the-money options, which is calculated based on the average share price for each

fiscal period using the treasury stock method. Under the treasury stock method, the tax-effected proceeds that would be hypothetically

received from the exercise of all in-the-money options are assumed to be used to repurchase shares. In fiscal 2005, the dilutive impact

of in-the-money employee stock options was approximately 125 million shares or 1.9% of the basic shares outstanding based on

Cisco’s average share price of $18.80.

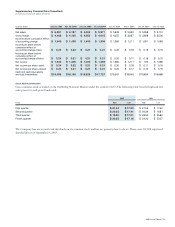

The following table summarizes the options granted to the Named Executive Officers during the periods indicated. The Named

Executive Officers represent the Company’s Chief Executive Officer and the four other most highly paid executive officers whose salary

and bonus for the years ended July 30, 2005 and July 31, 2004 were in excess of $100,000.

July 30, 2005

4 million

2.2%

0.06%

4.1%

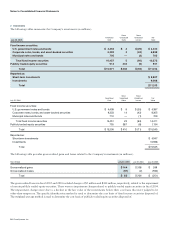

Notes to Consolidated Financial Statements