Cisco 2005 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

49

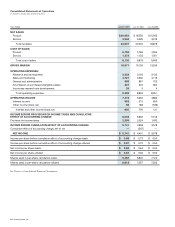

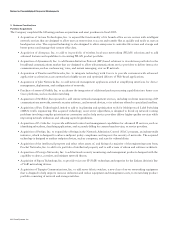

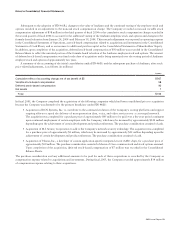

A summary of the acquisitions and asset purchases is as follows (in millions):

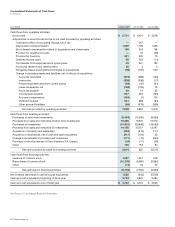

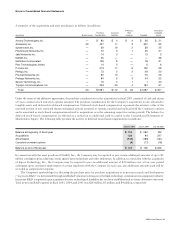

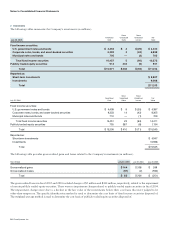

Under the terms of the definitive agreements, the purchase consideration for the acquisitions in fiscal 2005 consisted of cash and shares

of Cisco common stock and stock options assumed. The purchase consideration for the Company’s acquisitions is also allocated to

tangible assets and deferred stock-based compensation. Deferred stock-based compensation represents the intrinsic value of the

unvested portion of any restricted shares exchanged, options assumed, or options canceled and replaced with the Company’s options

and is amortized as stock-based compensation related to acquisitions over the remaining respective vesting periods. The balance for

deferred stock-based compensation is reflected as a reduction to additional paid-in capital in the Consolidated Statements of

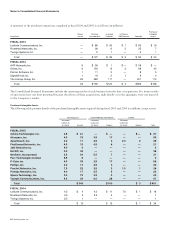

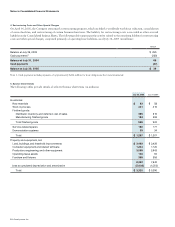

Shareholders’ Equity. The following table presents the activity of deferred stock-based compensation (in millions):

July 30, 2005

$ 153

128

(140)

(4)

$ 137

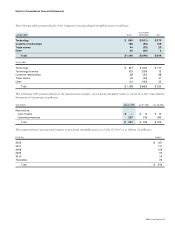

In connection with the asset purchase of NetSift, Inc., the Company may be required to pay certain additional amounts of up to $5

million contingent upon achieving certain agreed-upon technology and other milestones. In addition, in connection with the acquisition

of Sipura Technology, Inc., the Company may be required to pay an additional amount of $50 million over a four-year period

contingent upon continued employment of certain employees with the Company. In each case, any additional amounts paid will be

recorded as compensation expense.

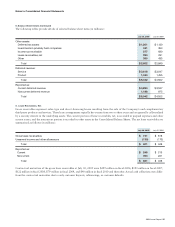

The Company’s methodology for allocating the purchase price for purchase acquisitions to in-process research and development

(“in-process R&D”) is determined through established valuation techniques in the high-technology communications equipment industry.

In-process R&D is expensed upon acquisition because technological feasibility has not been established and no future alternative uses exist.

Total in-process R&D expense in fiscal 2005, 2004, and 2003 was $26 million, $3 million, and $4 million, respectively.

Notes to Consolidated Financial Statements