Cisco 2005 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

47

Employee Stock Benet Plans The Company accounts for stock-based awards to employees and directors using the intrinsic value method

of accounting in accordance with Accounting Principles Board Opinion No. 25, “Accounting for Stock Issued to Employees”

(“APB 25”). Under the intrinsic value method, because the exercise price of the Company’s employee stock options equals the market price of

the underlying stock on the date of grant, no compensation expense is recognized in the Company’s Consolidated Statements of Operations.

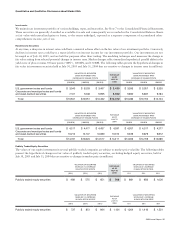

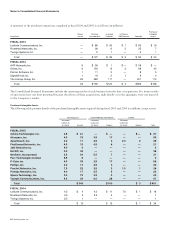

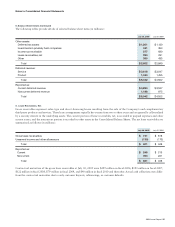

Pro forma information regarding option grants made to the Company’s employees and directors and common stock issued

pursuant to the Employee Stock Purchase Plan is based on specified valuation techniques that produce estimated compensation

charges. The following table reflects the pro forma information (in millions, except per-share amounts):

July 30, 2005

$ 5,741

(1,628)

594

(1,034)

$ 4,707

$ 0.88

$ 0.87

$ 0.73

$ 0.71

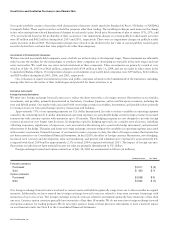

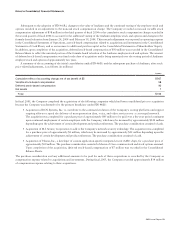

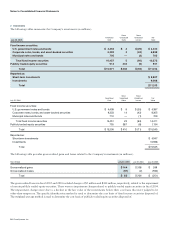

The value of each option grant is estimated as of the date of grant using the Black-Scholes option pricing model, which was developed

for use in estimating the value of traded options that have no vesting restrictions and are fully transferable. Because the Company’s

employee stock options have characteristics significantly different from those of traded options, and because changes in the subjective

input assumptions can materially affect the estimated value, in management’s opinion, the existing valuation models do not provide a

reliable measure of the fair value of the Company’s employee stock options. See Note 10 for additional information regarding this

pro forma information.

Recent Accounting Pronouncement In December 2004, the FASB issued Statement No. 123 (revised 2004), “Share-Based Payment”

(“SFAS 123(R)”), which requires the measurement and recognition of compensation expense for all stock-based compensation

payments and supersedes the Company’s current accounting under APB 25. SFAS 123(R) is effective for all annual periods beginning

after June 15, 2005. In March 2005, the Securities and Exchange Commission issued Staff Accounting Bulletin No. 107 (“SAB 107”)

relating to the adoption of SFAS 123(R).

The Company adopted SFAS 123(R) in the first quarter of fiscal 2006 and will continue to evaluate the impact of SFAS 123(R)

on its operating results and financial condition. The pro forma information presented above and in Note 10 presents the estimated

compensation charges under Statement of Financial Accounting Standards No. 123, “Accounting for Stock-Based Compensation.”

The Company’s assessment of the estimated compensation charges is affected by the Company’s stock price as well as assumptions

regarding a number of complex and subjective variables and the related tax impact. These variables include, but are not limited to,

the Company’s stock price volatility and employee stock option exercise behaviors. The Company will recognize the compensation

cost for stock-based awards issued after July 30, 2005 on a straight-line basis over the requisite service period for the entire award.

Reclassications Certain reclassifications have been made to prior year balances in order to conform to the current year’s presentation.

Notes to Consolidated Financial Statements