Cisco 2005 Annual Report Download - page 33

Download and view the complete annual report

Please find page 33 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.36

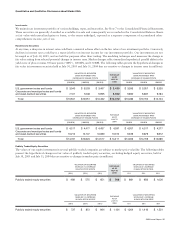

Other Commitments

We have entered into an agreement to invest approximately $800 million in venture funds managed by SOFTBANK Corp. and its

affiliates (“SOFTBANK”) that are required to be funded on demand. The total commitment is to be invested in venture funds and as

senior debt with entities as directed by SOFTBANK. Our commitment to fund the senior debt is contingent upon the achievement of

certain agreed-upon milestones. As of July 30, 2005, we have invested $414 million in the venture funds and $49 million in the senior

debt, of which $47 million has been repaid, and both were recorded as investments in privately held companies in our Consolidated

Balance Sheets. We had invested $290 million in the venture funds and $49 million in the senior debt as of July 31, 2004.

We provide structured financing to certain qualified customers for the purchase of equipment and other needs through our wholly

owned subsidiaries. These loan commitments may be funded over a two- to three-year period, provided that these customers achieve

specific business milestones and satisfy certain financial covenants. As of July 30, 2005, our outstanding loan commitments were $17

million and all were eligible for draw-down. As of July 31, 2004, our outstanding loan commitments were $61 million, of which $22

million was eligible for draw-down.

As of July 30, 2005 and July 31, 2004, we had a commitment of approximately $25 million and $59 million, respectively, to

purchase the remaining minority interest of Cisco Systems, K.K. (Japan), and we expect to make the final payment in fiscal 2006.

We also have certain other funding commitments related to our privately held investments that are based on the achievement of certain

agreed-upon milestones. The funding commitments were $56 million as of July 30, 2005, compared with $67 million as of July 31, 2004.

Off-Balance Sheet Arrangements

We consider our investments in unconsolidated variable interest entities to be off-balance sheet arrangements. In the ordinary course

of business, we have investments in privately held companies and provide structured financing to certain customers through our wholly

owned subsidiaries, which may be considered to be variable interest entities. We have evaluated our investments in these privately held

companies and structured financings and have determined that there were no significant unconsolidated variable interest entities

as of July 30, 2005.

Certain events can require a reassessment of our investments in privately held companies or structured financings to determine

if they are variable interest entities and if we would be regarded as the primary beneficiary. As a result of such events, we may be

required to make additional disclosures or consolidate these entities. Because we may not control these entities, we may not have

the ability to influence these events.

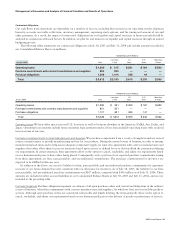

Stock Repurchase Program

In September 2001, our Board of Directors authorized a stock repurchase program. As of July 30, 2005, our Board of Directors has

authorized the repurchase of up to $35 billion of common stock under this program. During fiscal 2005, we repurchased and retired

540 million shares of our common stock at an average price of $18.95 per share for an aggregate purchase price of $10.2 billion. As

of July 30, 2005, we have repurchased and retired 1.5 billion shares of our common stock at an average price of $18.15 per share for

an aggregate purchase price of $27.2 billion since inception of the stock repurchase program, and the remaining authorized amount

under the stock repurchase program was $7.8 billion with no termination date.

The purchase price for the shares of our common stock repurchased was reflected as a reduction to shareholders’ equity.

In accordance with Accounting Principles Board Opinion No. 6, “Status of Accounting Research Bulletins,” we are required to

allocate the purchase price of the repurchased shares as a reduction to retained earnings and common stock and additional paid-in

capital. Issuance of common stock and the tax benefit related to employee stock option plans are recorded as an increase to common

stock and additional paid-in capital. As a result of future repurchases, we may be required to report an accumulated deficit included

in shareholders’ equity in our Consolidated Balance Sheets.

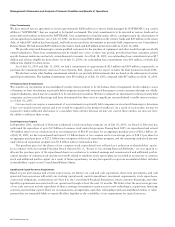

Liquidity and Capital Resource Requirements

Based on past performance and current expectations, we believe our cash and cash equivalents, short-term investments, and cash

generated from operations will satisfy our working capital needs, capital expenditures, investment requirements, stock repurchases,

contractual obligations, commitments (see Note 8 to the Consolidated Financial Statements), future customer financings, and other

liquidity requirements associated with our operations through at least the next 12 months. We believe that the most strategic uses

of our cash resources include repurchase of shares, strategic investments to gain access to new technologies, acquisitions, financing

activities, and working capital. There are no transactions, arrangements, and other relationships with unconsolidated entities or other

persons that are reasonably likely to materially affect liquidity or the availability of our requirements for capital resources.

Management’s Discussion and Analysis of Financial Condition and Results of Operations