Cisco 2005 Annual Report Download - page 34

Download and view the complete annual report

Please find page 34 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

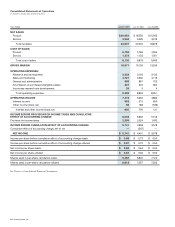

37

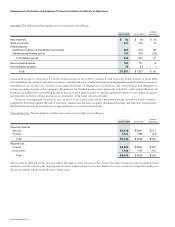

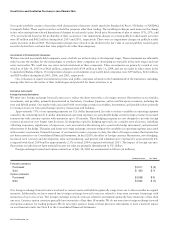

Investments

We maintain an investment portfolio of various holdings, types, and maturities. See Note 7 to the Consolidated Financial Statements.

These securities are generally classified as available-for-sale and consequently are recorded in the Consolidated Balance Sheets

at fair value with unrealized gains or losses, to the extent unhedged, reported as a separate component of accumulated other

comprehensive income, net of tax.

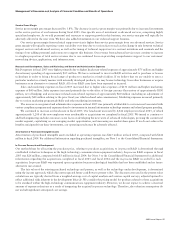

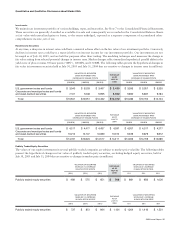

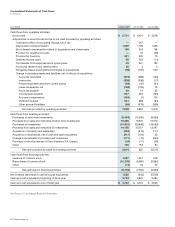

Fixed Income Securities

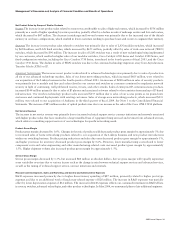

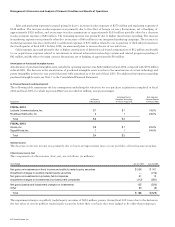

At any time, a sharp rise in interest rates could have a material adverse effect on the fair value of our investment portfolio. Conversely,

declines in interest rates could have a material effect on interest income for our investment portfolio. Our investments are not

leveraged as of July 30, 2005, and are held for purposes other than trading. The modeling technique used measures the change in

fair value arising from selected potential changes in interest rates. Market changes reflect immediate hypothetical parallel shifts in the

yield curve of plus or minus 50 basis points (“BPS”), 100 BPS, and 150 BPS. The following tables present the hypothetical changes in

fair value in investment securities held at July 30, 2005 and July 31, 2004 that are sensitive to changes in interest rates (in millions):

FAIR VALUE

AS OF

JULY 30,

2005

$ 3,430

6,942

$ 10,372

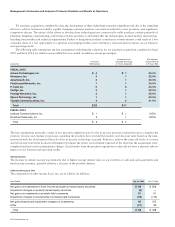

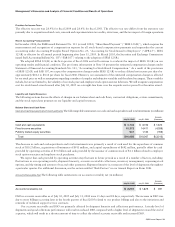

Publicly Traded Equity Securities

The values of our equity investments in several publicly traded companies are subject to market price volatility. The following tables

present the hypothetical changes in fair value of publicly traded equity securities, excluding hedged equity securities, held at

July 30, 2005 and July 31, 2004 that are sensitive to changes in market price (in millions):

FAIR VALUE

AS OF

JULY 30,

2005

$ 766

Quantitative and Qualitative Disclosures about Market Risk