Cisco 2005 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

62

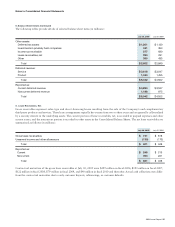

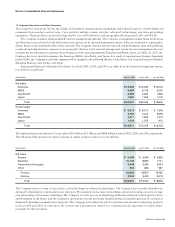

9. Shareholders’ Equity

Stock Repurchase Program

In September 2001, the Company’s Board of Directors authorized a stock repurchase program. As of July 30, 2005, the Company’s

Board of Directors had authorized the repurchase of up to $35 billion of common stock under this program. During fiscal 2005, the

Company repurchased and retired 540 million shares of Cisco common stock at an average price of $18.95 per share for an aggregate

purchase price of $10.2 billion. As of July 30, 2005, the Company had repurchased and retired 1.5 billion shares of Cisco common

stock for an average price of $18.15 per share for an aggregate purchase price of $27.2 billion since inception of the stock repurchase

program, and the remaining authorized amount for stock repurchases under this program was $7.8 billion with no termination date.

The purchase price for the shares of the Company’s common stock repurchased was reflected as a reduction to shareholders’

equity. In accordance with Accounting Principles Board Opinion No. 6, “Status of Accounting Research Bulletins,” the Company

is required to allocate the purchase price of the repurchased shares as a reduction to retained earnings and common stock and

additional paid-in capital.

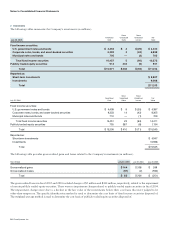

Shareholders’ Rights Plan

In June 1998, the Board of Directors approved a Shareholders’ Rights Plan (“Rights Plan”) which was intended to protect shareholders’

rights in the event of an unsolicited takeover attempt. On March 24, 2005, the Board of Directors approved an amendment to

the Company’s Rights Agreement to advance the Final Expiration Date of the Rights under the Rights Plan pursuant to the Rights

Agreement from the close of business on June 19, 2008 to March 28, 2005, effectively terminating the Rights Plan as of the close of

business on March 28, 2005.

Preferred Stock

Under the terms of the Company’s Articles of Incorporation, the Board of Directors may determine the rights, preferences, and terms

of the Company’s authorized but unissued shares of preferred stock.

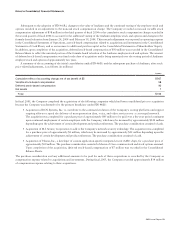

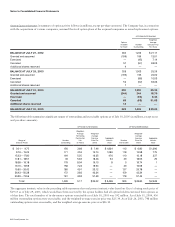

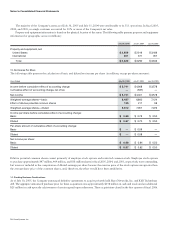

Comprehensive Income

The components of comprehensive income are as follows (in millions):

July 30, 2005

$ 5,741

(25)

10

5,726

77

$ 5,803

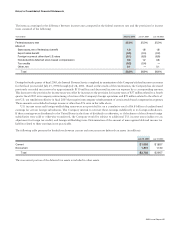

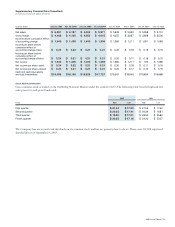

The Company consolidates its investment in a venture fund managed by SOFTBANK as it is the primary beneficiary as defined under

FIN 46(R). During fiscal 2005, SOFTBANK’s aggregate minority share of the venture fund decreased by $77 million, from $84 million

as of July 31, 2004 to $7 million as of July 30, 2005, as a result of a noncash distribution of the venture fund assets to its partners.

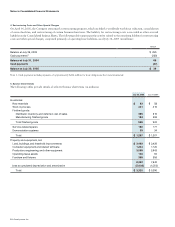

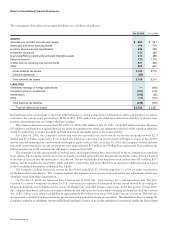

10. Employee Benefit Plans

Employee Stock Purchase Plan

The Company has an Employee Stock Purchase Plan, which includes its subplan, the International Employee Stock Purchase Plan

(together, the “Purchase Plan”), under which 321.4 million shares of the Company’s common stock have been reserved for issuance.

Eligible employees may purchase a limited number of shares of the Company’s common stock at a discount of up to 15% of the market

value at certain plan-defined dates. The Purchase Plan terminates on January 3, 2010. In fiscal 2005, 2004, and 2003, the shares issued

under the Purchase Plan were 19 million, 26 million, and 23 million shares, respectively. At July 30, 2005, 120 million shares were

available for issuance under the Purchase Plan.

Notes to Consolidated Financial Statements