Cisco 2005 Annual Report Download - page 50

Download and view the complete annual report

Please find page 50 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

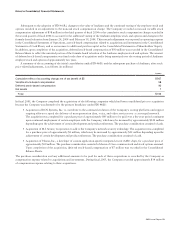

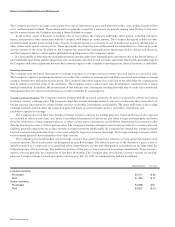

Subsequent to the adoption of FIN 46(R), changes to the value of Andiamo and the continued vesting of the employee stock and

options resulted in an adjustment to the noncash stock compensation charge. The Company recorded a noncash variable stock

compensation adjustment of $58 million in the third quarter of fiscal 2004 to the cumulative stock compensation charge recorded in

the second quarter of fiscal 2004 to account for the additional vesting of the Andiamo employee stock and options and changes in the

formula-based valuation from January 24, 2004 until February 19, 2004. This noncash adjustment was reported as operating expense

in the Consolidated Statements of Operations, as stock-based compensation related to acquisitions and investments in the Consolidated

Statements of Cash Flows, and as an increase to additional paid-in capital in the Consolidated Statements of Shareholders’ Equity.

In addition, upon completion of the acquisition, deferred stock-based compensation of $90 million was recorded in the Consolidated

Balance Sheets to reflect the unvested portion of the formula-based valuation of the Andiamo employee stock and options. The amount

of deferred stock-based compensation was fixed at the date of acquisition and is being amortized over the vesting period of Andiamo

employee stock and options of approximately two years.

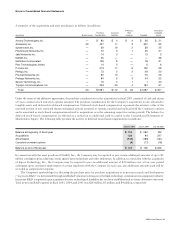

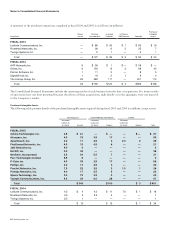

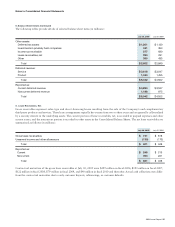

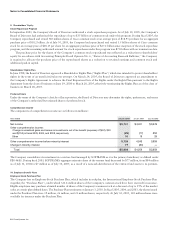

A summary of the accounting of the initial consolidation under FIN 46(R) and the subsequent purchase of Andiamo, after stock

price-related adjustments, is as follows (in millions):

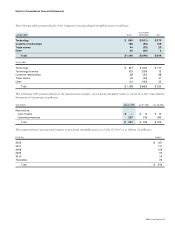

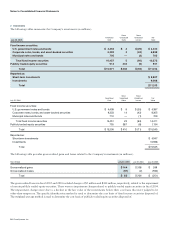

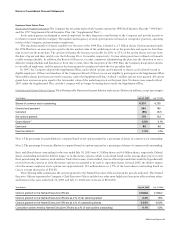

In fiscal 2005, the Company completed the acquisitions of the following companies which had been consolidated prior to acquisition

because the Company was deemed to be the primary beneficiary under FIN 46(R):

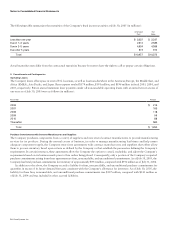

• Acquisition of BCN Systems, Inc. to contribute to the continued evolution of the Company’s routing platforms and support

ongoing efforts to speed the delivery of next-generation data, voice, and video services over a converged network.

The acquisition was completed for a purchase price of approximately $45 million to be paid over a five-year period contingent

upon continued employment of certain employees with the Company, which may be increased by approximately $122 million

depending upon the achievement of certain development and product milestones. The purchase consideration consisted of cash.

• Acquisition of M.I. Secure, Corporation to add to the Company’s network security technology. The acquisition was completed

for a purchase price of approximately $1 million, which may be increased by approximately $12 million depending upon the

achievement of certain development and product milestones. The purchase consideration consisted of cash.

• Acquisition of Vihana, Inc., a developer of custom application-specific integrated circuit (ASIC) chips, for a purchase price of

approximately $30 million. The purchase consideration consisted of shares of Cisco common stock and stock options assumed.

Upon completion of the acquisition, deferred stock-based compensation of $7 million was recorded in the Consolidated

Balance Sheets.

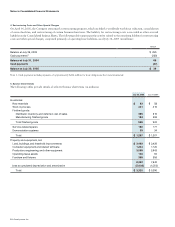

The purchase consideration and any additional amounts to be paid for each of these acquisitions is recorded by the Company as

compensation expense related to acquisitions and investments. During fiscal 2005, the Company recorded approximately $34 million

of compensation expense relating to these acquisitions.

Notes to Consolidated Financial Statements