Cisco 2005 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2005 Cisco annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

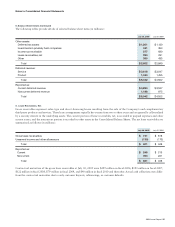

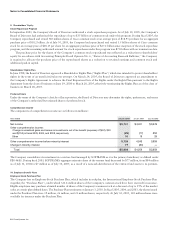

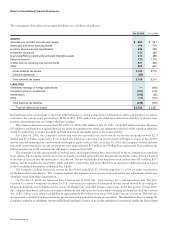

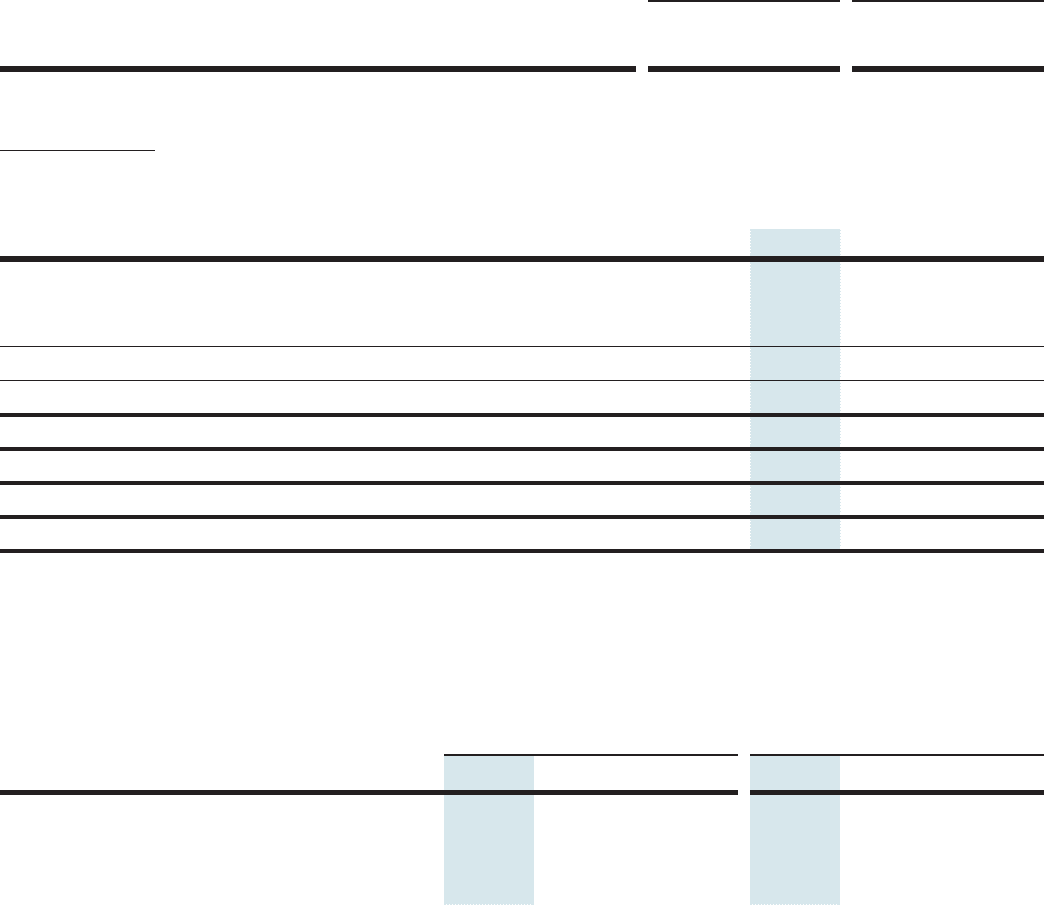

The following table presents the option exercises for the year ended July 30, 2005, and option values as of that date for the Named

Executive Officers (in millions):

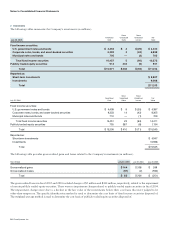

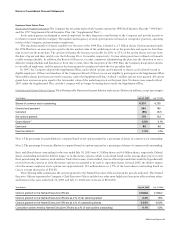

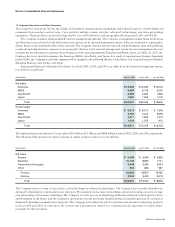

Pro Forma Information Pro forma information regarding option grants made to the Company’s employees and directors and common stock

relating to the Employee Stock Purchase Plan is based on specified valuation techniques that produce estimated compensation charges.

The following table reflects the pro forma information (in millions, except per-share amounts):

July 30, 2005

$ 5,741

(1,628)

594

(1,034)

$ 4,707

$ 0.88

$ 0.87

$ 0.73

$ 0.71

The pro forma net income for fiscal 2005 includes the effects of new U.S. tax regulations effective in fiscal 2005 that require intercompany

reimbursement of certain stock-based compensation expenses.

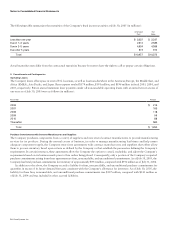

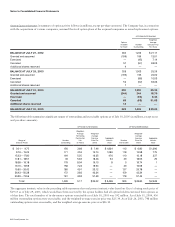

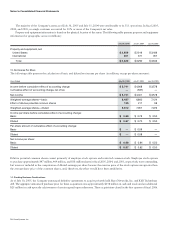

The value of each option grant is estimated on the date of grant using the Black-Scholes option pricing model with the following

weighted-average assumptions:

July 30, 2005 July 30, 2005

0.0% 0.0%

3.6% 2.0%

39.6% 33.2%

3.3 0.6

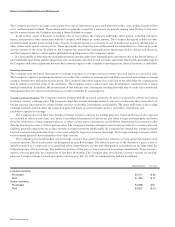

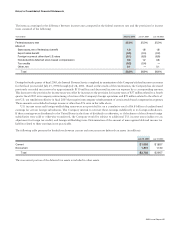

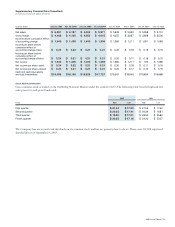

The Black-Scholes option pricing model was developed for use in estimating the value of traded options that have no vesting restrictions

and are fully transferable. In addition, option pricing models require the input of highly subjective assumptions, including the expected

stock price volatility and expected life. The Company is responsible for determining the assumptions for the expected volatility and

expected life of its stock options used in estimating the fair value of those options. The Company uses third-party analysis to assist in

developing the expected volatility and expected life of its stock options. The expected life and expected volatility of the stock options

is based upon historical and other economic data trended into the future. The Company uses an option pricing model to indirectly

estimate the expected life of the stock options. Because the Company’s employee stock options have characteristics significantly

different from those of traded options, and because changes in the subjective input assumptions can materially affect the estimated

value, in management’s opinion, the existing valuation models do not provide a reliable measure of the fair value of the Company’s

employee stock options. Under the Black-Scholes option pricing model, the weighted-average estimated values of employee stock

options granted during fiscal 2005, 2004, and 2003 were $6.19, $8.77, and $5.67, respectively.

Notes to Consolidated Financial Statements